Authors

Content

Foreword

By Angus MacNeil MP, Member of Parliament for Na h-Eileanan an Iar

Chair of the Energy Security and Net Zero Select Committee

Net Zero is not just a climate commitment, it is also the foundation for our economic development and energy security strategies, and hydrogen is at the heart of that transition. It’s true for Britain, and especially so for Scotland.

The UK enjoys strong natural advantages to become a world leader across the entire clean tech ecosystem, from the large underground caverns off the Yorkshire coast capable of storing carbon and hydrogen, to the powerful winds buffering my constituency of Na h-Eileanan. But we’re also struggling from our early success in the build out of renewables, which grew far faster than transmission capacity was able to keep up.

These grid constraints are already costing households and businesses over £1bn per year, and will increase to over £3bn annually before planned solutions are implemented over the next decade, leaving wind turbines to spin idly in the meantime. With growing concern over the cost of net zero, we need to be smarter in how we deliver decarbonisation.

As Policy Exchange’s excellent new report makes clear, we have every opportunity to make more efficient use of our existing energy infrastructure and leverage wasted renewable energy into clean hydrogen. Their proposal to work with industry could achieve major system savings and deliver major investments into hydrogen production capacity throughout northern Scotland and elsewhere in the UK. The potential output is massive, worth two thirds of our electrolysis target for 2030.

With Europe, the United States and countries around the world investing billions into their hydrogen sectors, Westminster needs to step up our policy game to remain competitive, not least in the lucrative hydrogen export market. Creative proposals like that of this report will help us get there.

Next chapter

Glossary

| Term | Definition |

| Biofuels | A range of fuels produced from various types of organic matter, including wood, crops, food waste and algae. |

| BTM | Behind-the-meter. Referring to an energy asset or activity, in this case electrolysers and electrolysis, occurring on the user’s side of the connection to the power grid. Inverse to “front-of-the-meter” which is directly connected to the power grid. |

| CCS | Carbon Capture and Storage. An emissions reduction process which involves capturing the CO2 produced by industry, and permanently storing it in a secure location underground. |

| CfD | Contracts for Difference. A long-term contract between a renewable electricity generator and Low Carbon Contracts Company (LCCC) representing the state, meant to stabilise costs and revenues at a pre-agreed level (the Strike Price). |

| CO2 | Carbon Dioxide (CO2) is the main greenhouse gas. The vast majority of CO2 emissions come from the burning of fossil fuels and land use changes, the growing accumulation of which is driving adverse effects on the earth’s climate |

| CO2e | Carbon Dioxide equivalent: A term used to account for the ‘basket’ of greenhouse gases and their relative effect on climate change compared to carbon dioxide. |

| Electrolysis | The process of using electricity to split water into its chemical components; Hydrogen and Oxygen. This output is known as electrolytic or ‘green’ hydrogen. |

| Hydrogen | A clear, odourless gas which is highly flammable, the most common element in the universe which can be used as a low emission alternative fuel source. |

| Hydrogen Economy | A vision of using hydrogen as an alternative low carbon energy carrier that can be used as a replacement in transport, heating fuel and also storage. |

| GW | Gigawatt. A measure of electrical output. One GW equals 1,000,000 kilowatts. |

| GWh | Gigawatt-hour. A measure of electrical energy equivalent to the power consumption of one gigawatt for one hour. One GWh equals 1,000,000 kilowatt hours. |

| MW | Megawatt. A measure of electrical output. One MW equals 1,000 kilowatts |

| MWh | Megawatt-hour. A measure of electrical energy equivalent to the power consumption of one megawatt for one hour. One MWh equals 1,000 kilowatt hours. |

| Ofgem | The Office of Gas and Electricity Markets, the regulator for energy markets in Great Britain. |

| PtG | Power-to-Gas. The conversion of surplus energy into a grid combustible gas. This surplus energy can produce hydrogen which can be mixed with natural gas and injected into the gas grid or in higher value markets such as hydrogen refuelling stations. |

| REMA | Review of Electricity Market Arrangements. A major regulatory and market reform initiative that will restructure Britain’s energy sector to enable high-renewable penetration and net zero over the next ten years and beyond. |

| SAF | Sustainable Aviation Fuel. A low or zero emission alternative to jet fuel. |

| SMR | Steam Methane Reformation. A process in which methane (from natural gas) is heated, along with steam and a catalyst, to produce a mixture of carbon monoxide and hydrogen which can be used in organic synthesis and as a fuel. |

Executive Summary

A world-class fleet of wind turbines is growing around and off the coastlines of Great Britain and Northern Ireland, generating ever larger volumes of cheap, clean and secure energy. But the transmission and distribution infrastructure required to connect that generation with energy consumers hasn’t kept pace with the growth, leaving ever growing volumes of power wasted. This ‘curtailment’, when wind generators are instructed by the network operator to disconnect from the grid due to ‘constraints’ on our power system, is a costly problem.

Since 2021, power system congestion has cost consumers over £2bn, and in 2022 alone some £210m of curtailment payments were made to renewable generators under contract.1Carbon Tracker, Gone with the Wind. June 2023: https://carbontracker.org/reports/gone-with-the-wind/ As our offshore wind fleet grows from 14 gigawatts (GW) today to the 50 GW offshore wind target in 2030, we are on track for a fivefold increase in curtailment by 2030, wasting an amount of electricity equivalent to the annual electricity consumption of more than 5 million households.2Carbon Tracker, Gone with the Wind. June 2023: Gone with the wind? – Carbon Tracker Initiative Particularly consequential for this report are Scotland’s 8.8 GW of onshore wind capacity – growing to 20 GW by 2030 – set to face higher constraint frequency than more southerly resources.

A series of long-term initiatives are underway to help address these problems, including the development of new transmission infrastructure, energy storage assets, and the Review of Electricity Market Arrangements (REMA) reforms, but these plans will take over a decade to fully materialise, are expected to be outpaced by the addition of new generation, and envision a major role for hydrogen.

At this other end of the energy spectrum, Britain continues to face challenges in scaling our nascent hydrogen economy. While the majority of our economy can be decarbonised through electrification, low-carbon hydrogen must also play a major role in achieving net zero. Between heavy industry, sustainable aviation fuels, energy storage and much else, hydrogen is expected to deliver between a fifth and a third of Britain’s final energy consumption by 2050.3Energy System Operator, Future Energy Scenarios. July 2023: https://www.nationalgrideso.com/document/283101/download Even as the scale of its future role in decarbonisation remains unclear, hydrogen’s application for flexible power generation and long-duration storage will require a more than 100-fold increase in our clean hydrogen production capacity even under the most conservative forecast.4ibid

However, the sector faces an acute chicken-or-egg problem. The large upfront costs required for hydrogen production and transportation discourage early movers and impose high marginal prices, while prospective end-users are reluctant to invest in hydrogen infrastructure and handling equipment until a reliable and reasonably priced supply is readily available. Waiting on other jurisdictions to find these solutions is an option, but would see investment in Britain’s clean tech sector fall further behind in the hyper-competitive net zero economy, not least of all in conceding lucrative hydrogen export opportunities to ambitious adopters. Policy uncertainty is already wearing on Britain’s competitiveness in the sector, which has dropped from the second most attractive hydrogen economy in 2021 to the eighth position today.5Energy Networks Association, September 2023: https://www.energynetworks.org/newsroom/uk-slips-down-the-international-hydrogen-progress-index

Britain’s hydrogen sector has been recently boosted by a series of government announcements to fund hydrogen production, transportation and storage, and to permit blending hydrogen into the natural gas system. However, an important decision from the UK government on hydrogen’s role in residential heating is still awaited. Growing investment and technological improvements in America’s and Europe’s hydrogen sectors following passage of the Inflation Reduction Act (IRA) and Green Deal Industrial Plan, respectively, will add a sense of urgency to these developments.

Westminster’s current plans for the industry – the Net Zero Hydrogen Fund (NZHF) and the Hydrogen and Carbon Capture Cluster Sequences – are well received but encumbered by delays, likely falling well short of the target of 10 GW of hydrogen production capacity by 2030.

Fortunately, Britain has the opportunity to resolve both challenges. Our report, Turning Wasted Wind into Clean Hydrogen, developed with modelling from LCP Delta, explores the potential of leveraging these billions of pounds of curtailed generation for green hydrogen production over the next ten years and beyond. At present, there is insufficient incentive – and significant barriers – for energy market participants to make use of curtailed wind for productive purposes. This is particularly acute for the generators under the Contracts for Difference (CfD) regime. When these generators are told to ‘curtail’ their output because of downstream grid constraints, they are still paid in full, congestion payments cost over £350 million between 2021-2022 – with curtailment costs recast to surpass £3.5 bn annually by the end of the decate.6Carbon Tracker, Gone with the Wind. June 2023: https://carbontracker.org/reports/gone-with-the-wind/

Unlocking these opportunities would reduce wasted energy, relieve pressure on consumer bills, and accelerate development of a critical, emerging sector for our climate economy. At a time when the government is keen to avoid imposing new costs onto consumers in the transition to net zero, the first course of action should be to make more efficient use of existing system resources. A successful strategy would see us leverage our natural comparative advantages to emerge as a global leader in a highly competitive hydrogen market with tremendous export potential.

With modelling conducted by LCP Delta, our research finds that in 2022 we experienced curtailed wind generation sufficient to produce over 118,000 tonnes of green hydrogen, rising to 455,000 tonnes by 2029. This is enough hydrogen to:

- displace two-thirds of the 700,000 tonnes of the UK’s current, carbon-intensive grey hydrogen consumption annually;

- decarbonise the entirety of the UK’s 7m tonne annual steel manufacturing;

- meet over 90% of our national Sustainable Aviation Fuel (SAF) target for 2030; or

- deliver two thirds of our electrolyser production capacity target for 2030.

The first section of this report focuses on the current state of the UK’s wind and hydrogen markets, explaining the nature of generation procurement, our grid development strategy, and how constraints arise. With analysis from LCP Delta, we include forecasts of growing curtailment figures through additional procurement over the course of the decade, which continues to increase until significant energy storage and transmission expansion projects are brought online. We further detail the history and potential role of hydrogen as a low-carbon energy carrier, which under even the most conservative future scenario envisions a major role for low-carbon hydrogen in seasonal energy storage and industrial decarbonisation. The second section of our report explores the potential for regulatory and market reforms that would allow us to instead invest those costs into electrolyser capacity and hydrogen offtake agreements, thereby turning wasted wind into a valuable, emissions-free energy carrier.

With the lion’s share of wind curtailment currently occurring in Scotland, our report is particularly focused on capitalising on those specific circumstances. However, with grid constraints forecast to increase in much of the UK – notably Wales and East Anglia – these reforms could be implemented to beneficial effect throughout the country. Hydrogen is by no means the only solution, and other flexibility services such as battery storage and demand response are essential, but these technologies are already better prepared to scale without further policy support.

Scaling electrolysers as a flexible energy resource throughout the nation will allow for far greater integration of wind generation than currently possible, particularly of those assets otherwise waiting over a decade for a grid connection, and position Britain into a far stronger position on competing for hydrogen exports to Europe. Such reforms are particularly critical in anticipation of our target to achieve 95% of generation from low-carbon sources by 2030 and the role of hydrogen to balance the grid, when more than half of all hours could see excess generation.7Flint Global, British Energy Security Strategy: Homegrown clean power, but at what cost? 14 April 2022: https://flint-global.com/blog/british-energy-security-strategy-homegrown-clean-power-but-at-what-cost/

Leveraging curtailed renewables is no panacea for enabling low-cost and widespread access to green hydrogen. We recognise the development challenges to be managed, including water access availability, intermittency, lack of hydrogen storage and distribution infrastructure, and demand side uncertainty. The central value of our proposal is not to resolve these problems entirely, but to encourage policy development that would enable innovative market participants to capitalise on some of the billions of pounds of clean, homegrown energy that we’re currently on track to waste over the next decade.

Next chapterRecommendations: Make it, Move it, Use it

Achieving an economically beneficial solution to the confluence of a constrained wind sector and nascent hydrogen economy will require policies to stimulate three concurrent processes across the energy sector.

- First, wind generators – particularly those eligible for constraint payments – must be provided with a combination of positive and negative incentives to develop arrangements with electrolysers to offtake their surplus power generation.

- Second, these electrolysers – which can be either co-located with a generator (known as behind-the-meter, or BTM), or connected to the grid and maintain a Power Purchase Agreement (PPA) with one or multiple proximate generators – must be incentivized and sustained through a viable business model to consume electricity during curtailment events.

- Third, their hydrogen production must be delivered to an industrial consumer or other end-use.

The recommendations below outline specific actions that can be taken by the government, Ofgem and the ESO to encourage and achieve these processes:

- Collaborate with Industry on Developing ‘Constraint Management Plans’: renewable energy assets and their contract holders are not homogenous, and optimal solutions will be different according to varied technology type, locations, and business models. Instead of a top-down instruction, the government should instruct frequently constrained generators to develop ‘Constraint Management Plans’ (CMPs) with incentives for partnering with electrolysers.

- Amend the Contracts for Difference (CfD) regime: without upsetting contractual obligations, existing generators under CfD should be provided a stronger incentive to reduce receipt of constraint payments and be encouraged to redirect their generation for productive purposes. Contracted generators in highly constrained grid locations should be required to adopt CMPs for their output, with financial incentives for entering into offtake agreements with electrolysers – either BTM or PPAs with electrolysers in suitable proximate location – at the determination of the Future System Operator (FSO).

Generators without constraint management plans may see their constraint payments scaled back in the long-term, and all constraint payments may be reduced, capped, or removed in the medium-term future. To optimise efficiency, the scheme could be operated as a credit market, whereby generators with excess offtake could sell their output as credits to generators with insufficient or no CMPs.

For future CfD auctions, concerning projects in grid constrained locations, advantages should be afforded to bids with comprehensive CMPs that include electrolysis, in line with the government’s intention to consider ‘non-price’ factors.

- Allow Flexibility in System Charges to Discourage Curtailment: all energy market participants in the UK are subject to a range of system charges to recover the cost of managing the power system. Generators in constrained areas should be incentivised to develop and execute CMPs that reduce congestion through offtake agreements with electrolysers through flexible application of these charges, such as a reduction of the Transmission Network Use of System (TNUoS) charges.

For future generation assets, a major incentive for adopting comprehensive CMPs would be to offer a significant reduction or complete waiver on Connection Charges, which represents one of the single largest upfront expenses for new generation projects.

- Share Realised Constraint Management Savings with Electrolysers: in alignment with offtake agreements described below, allow for ‘revenue stacking’ for grid-connected electrolysers. Beyond payments for flexibility services, sale of hydrogen, and CMP payments, electrolysers whose consumption reduces constraint costs should be entitled to a portion of those savings through CMP payments, with the mechanism and portion of savings to be determined by the Future System Operator (FSO).

Further, where electrolyser demand is deemed to have enabled additional system savings, such as avoiding or delaying need for additional grid capacity, those savings should similarly be shared with electrolyser operators in an equitable manner. To further improve investability for early-movers, a short-term exemption from electricity levies for electrolysers in grid constrained areas could be introduced.

- Provide Offtake Contracts for Grid Managing Electrolysers: a financial incentive similar to the Green Gas Support Scheme (GGSS) should be introduced to encourage and reduce capital costs for investments in electrolysers in constrained zones. Following the logic of a CfD, the government should offer a price floor and ceiling model, aligned with the mechanism offered by the Hydrogen Production Business Model (HPBM). This model would differ from the HPBM by targeting grid management as a core function, along with the opportunity to receive financial support from CMPs.

A 15-year contract length is a feasible duration, with clear allowance and encouragement for the upgrading of these assets as electrolysis technology rapidly improves over the medium-term, particularly to accommodate the intermittency of renewable generation. The opportunity for longer terms should be explored to achieve greater investor certainty and thereby cost reduction.

- Introduce Hydrogen ‘Matchmaking’ Initiative: the British hydrogen market remains highly opaque, with a lack of advance clarity over emerging hydrogen production, distribution, and consumption projects. This information gap impairs market participants’ ability to plan for and support future developments. In the United States, the Office of Energy Efficiency & Renewable Energy, within the Department of Energy, has developed the ‘H2 Matchmaker’ resource to connect stakeholders.8https://www.energy.gov/eere/fuelcells/h2-matchmaker

The UK should mimic this low-cost and easily accessible initiative to support the emergence of hydrogen hubs. The Department for International Trade (DIT) should embrace an early responsibility in helping foster export opportunities to Europe.

- Approve Hydrogen Blending with a Strategic Focus on Production: ambitions to develop a 20% hydrogen blend into our natural gas system would in many cases prove to be an inefficient approach to emissions reduction and new technology adoption , as recognised by the government’s recent, tentantive steps to approve blending pending conclusion of safety trials.9Department for Energy Security & Net Zero, Hydrogen blending in GB distribution networks: strategic decision, December 2023: https://www.gov.uk/government/publications/hydrogen-blending-in-gb-distribution-networks-strategic-decision At the same time, developing a curtailed-wind-to-hydrogen scheme as described in this report would inevitably see production scale fast ahead of viable consumption within constrained areas.

Instead of targeting a 20% blend, the government should permit blending as an interim measure to act as a reserve offtaker and strategic enabler for green hydrogen electrolysed in constrained grid locations where commercial off-takers are not present, in order to provide greater investment certainty. As a condition of blending, hydrogen producers must demonstrate active efforts to partner with commercial off-takers, delivered to industrial clusters, or injected to long-duration storage applications.

Next chapterIntroduction

The power grid is a feat of modern engineering, a collection of assets that cumulatively represent the single largest ‘machine’ of any kind. Great Britain boasts one of the oldest in the world; Mosley Street in Newcastle was the very first to adopt incandescent electric streetlights in 1879. Three years later Thomas Edison opened the first coal fired power plant in London, and in 1935 we inaugurated the first truly national grid by connecting independent urban systems from Glasgow to Leeds and Bristol.

Our National Grid came into its modern form after the Second World War, with a series of large generating stations – primarily coal and nuclear – connected by high-voltage transmission lines with proximate demand centres; cities in the South and heavy industry in the Midlands.

However, as in most peer economies, Britain’s power grid has struggled to keep pace with the technical challenges of transitioning to low-carbon energy resources. Rather than dozens of centrally located thermal stations, our generation mix now consists of thousands of disparate and often remotely located power assets. Whereas a coal plant could be powered up and down to match demand, renewable generation is intermittent and difficult to accurately forecast, a challenge that will increase over the coming decades.

Customers, too, are growing more sophisticated. Once passive consumers of power, growing numbers are adopting rooftop solar and battery storage systems, selling power back onto the grid. Increasingly, so will electric vehicles (EVs), which will soon account for several power plants worth of cumulative capacity. Even household appliances like fridges are becoming “smart”, capable of responding to price signals. All the same, hotter summers and air conditioners are creating new ‘peak’ events that can strain the grid to its limits.

All of this is occurring in the midst of decarbonising our broader economy by 2050, with the electrification of heating and transportation, and a growing role for clean hydrogen in industrial processes set to double or even triple our electricity demand within a generation.

At the conclusion of this evolution, Great Britain will have a stronger, cleaner, and more reliable grid. Expensive and volatile fossil fuel imports from foreign regimes will be replaced with home-grown, zero-marginal cost and emissions-free power generation. But in the meantime, transitioning our 20th century grid – as well as its underlying regulations and market design – for the 21st century is exposing us to new challenges, imposing steep costs onto households, and leaving us with growing volumes of wasted power.

Our report, Turning Wasted Wind into Clean Hydrogen, sets out to explain the emergence of these issues, how the market manages constraint issues under the current regime, and the policy and infrastructure developments currently underway to help address these challenges by the 2030s. We focus on the potential to create new market opportunities to commercialise wasted electricity into green hydrogen production through electrolysis as an interim solution pending fulsome market reform.

This work builds upon Policy Exchange’s 2018 paper, Fuelling the Future: Hydrogen’s role in supporting the low-carbon economy, which envisioned much of the British government’s subsequent policy development in the sector, including prospects for leveraging curtailed renewable generation. We similarly draw upon our historic work on wind energy, including Powering Up: The Future of Onshore Wind in the UK (2015), The Future of the North Sea: Maximising the Contribution of the North Sea to Net Zero and Levelling Up (2020), and Crossed Wires: Maintaining Public Support for Offshore Wind Farms (2021).

Next chapterA Wind Energy Superpower

Within the last twenty years, Great Britain has achieved one of the greatest feats of global energy transition, growing our renewable sector from less than 3% of domestic generation into the world’s second largest offshore wind market today. This journey began in 1887, when James Blyth erected the world’s first electricity generating wind turbine in Marykirk, Scotland. Over the ensuing century, the high cost and technical challenges relegated wind energy to a minor role in the UK, with a notable exception of generation for remote islands like the Orkneys, where the country’s first grid connection was developed in the 1950s.

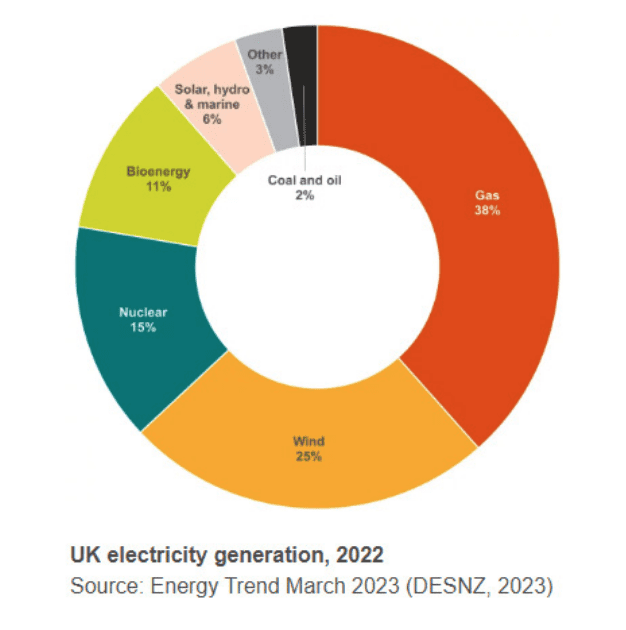

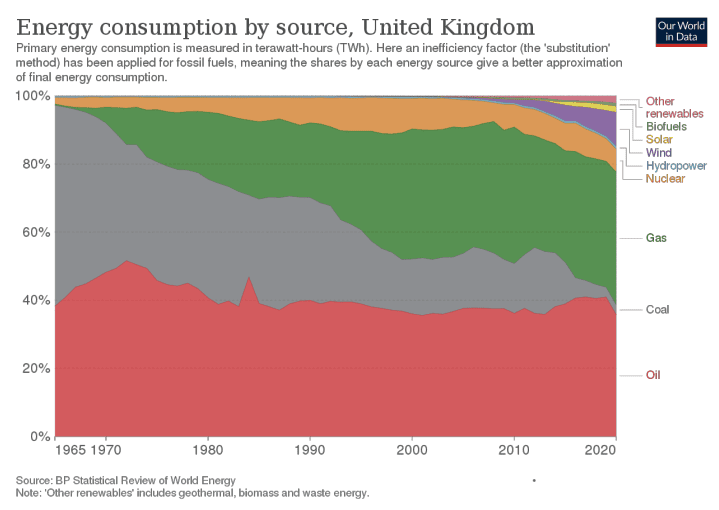

Coal, natural gas and nuclear power plants accounted for over 90% of domestic electricity supply by the turn of the millennium. While reliable and reasonably priced, it was achieved at a high carbon intensity of 483 grams of carbon dioxide equivalent per kilowatt-hour (gCO2e/kWh), notably higher than the EU’s average of 383 gCO2eq/kWh. To reduce these GHG emissions, the EU adopted its first ‘Renewable Energy Directive’ in 2001, for which the UK pledged to achieve a 1.3% share of renewable generation by 2005 and 15% by 2020.

The primary domestic policy for achieving this initial target was the ‘Renewable Obligation’ (RO) program introduced in April 2002, which required electricity suppliers to procure a growing portion of their generation from renewable sources.10In England, Wales, and Scotland. Northern Ireland adopted the policy in 2005. These policies superseded the Non-Fossil Fuel Obligation (NFFO) introduced by the Electricity Act 1989. When contracting electricity from renewable generators, suppliers were provided Renewable ‘Obligation Certificates’ (ROCs), which would be retired, and excess certificates could be sold to other suppliers – thereby enabling tradable market prices for ROCs. Concurrently, The Crown Estate took on a major role in the sector by holding their first seabed leasing round.

The RO was designed to be technology neutral, however this ultimately proved a weakness as suppliers were incentivised to procure from mature generation technologies such as hydro, biogas, and onshore wind, and to avoid emerging, costlier technologies such as offshore wind. Gradually, more generous allotments of ROCs for new generation types – known as “banding” – were introduced. As would become increasingly problematic in the future, the scheme did not deliver sufficient signals or incentives to expand grid infrastructure to accommodate new connections.

In 2007, Britain agreed to the EU’s increased target of 20% renewable generation by 2020. This coincided with the government’s seminal May 2007 white paper, Meeting the Energy Challenge, which recognized the growing challenges of fossil fuel dependency and articulated the goal of developing 30-35 GW of new generation capacity, particularly in the face of retiring nuclear and coal stations. Later that year, the Strategic Environmental Assessment was conducted to prepare 25 GW of offshore wind farm development, primarily in the North Sea. The Energy Act 2008 bolstered these objectives by introducing the Feed-in-Tariff (FIT) system to support smaller renewable generators under 5 MW by providing a ‘top-up’ for power sold to the grid.

At this still nascent stage for the sector, investor confidence was greatly bolstered by the cross-party support for increased renewable deployment. This was demonstrated by the near-unanimous support for the Climate Change Act 2008, which was opposed by only 5 out of 646 MPs and established the United Kingdom as a global leader by pledging to reduce carbon emissions by 80% by 2050. The Coalition Government continued this bi-partisan tradition with passage several vital programs, including the ‘Connect and Manage’ regime and the Energy Act 2013, which tightened the Emissions Performance Standard (EPS) to accelerate the phase-out of coal fired generation, introduced a Capacity Market, and launched the Contracts for Difference (CfD) scheme.11Annual Energy Statement. DECC Departmental Memorandum, 27 July 2010: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/47879/237-annual-energy-statement-2010.pdf

Network Policy

The ‘Connect and Manage’ regime introduced in July 2010 was meant to accelerate the connection of renewable generation, allowing developers permissions to connect to the power grid ahead of completing all necessary upgrades and reinforcements to the transmission network (also known as Enabling Works and Wider Works, respectively). What would later prove a major challenge is that once a project is connected to the grid, any downstream system constraints are the responsibility of the National Grid Electricity System Operator (NGESO). In other words, the developer would be compensated for their generation regardless of whether the power could be delivered.

Notably, National Grid’s guidance document explained “it is anticipated that the Enabling Works are only expected to be greater than the works necessary to connect to the MITS [Main Interconnected Transmission System] substation in exceptional circumstances.”12National Grid. Connect and Manage Guidance, March 2013: https://www.nationalgrid.com/sites/default/files/documents/5639-Connect%20and%20Manage%20-%20Updated%20Guidance.pdf Their prediction was ultimately very much off the mark and is the source of many of today’s grid constraints. Overall, investment in renewables capacity exceeds growth in transmission capacity fourfold over the past decade.

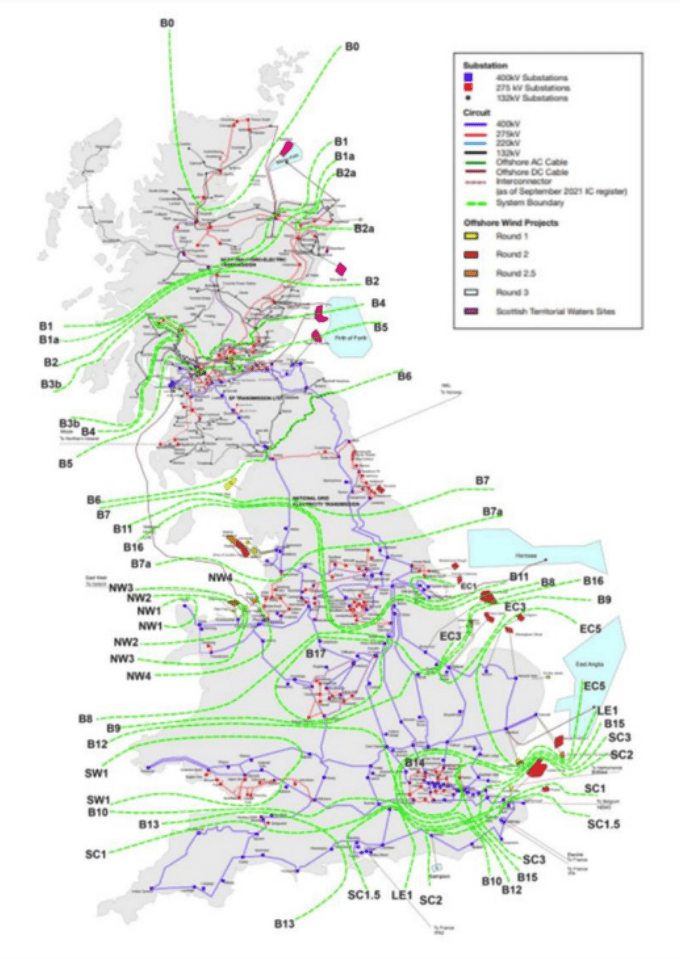

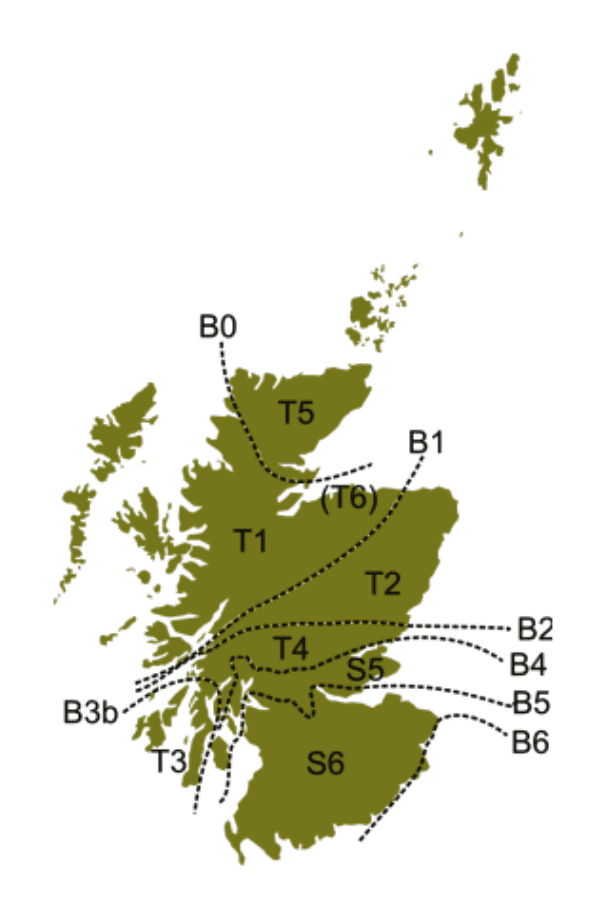

The British power grid is divided into a series of Boundaries delineated by the capacity connections between each zone, with the size of that capacity determining the maximum possible flow of power – see map to the right.13Nation Grid ESO – Electricity Ten Year Statement (ETYS 2022) This has proven problematic for the interface between many high-generation zones and their transmission connection to demand loads. The strain is most acute in Scotland, which hosts 40% of the UK’s wind generation while accounting for less than 10% of total demand.

In turn, 95% of all wind congestion events occur at the north of the B6 Boundary which separates Scotland from the rest of the UK.14Carbon Tracker, 2023. At only 6.1 W of capacity, the boundary can deliver less than half of Scotland’s 14 GW of installed renewable nameplate capacity. More localised constraints occur further north both concurrently and independently with constraints at B6, notably at the B1 boundary with 2.9 GW of capacity.15Hawker, G. The Potential for hydrogen to reduce curtailment of renewable energy in Scotland. Climate X Change, November 2022: https://www.climatexchange.org.uk/media/5627/the-potential-for-hydrogen-to-reduce-curtailment-of-renewable-energy-in-scotland-jan-23.pdf The proposals outlined in Section 7 of this report are intended to take place within these regions.

Renewable Procurement

The CfD scheme worked as a bi-annual reverse auction administered by National Grid through a design established by the government, inviting developers to bid for a set procurement target, thereby encouraging competitive pressure by selecting the lowest cost proposals. Successful bidders to the CfD are then offered a 15-year generation contract with the government-owned Low Carbon Contracts Company (LCCC). These contracts are the major advantage over the RO, as the price certainty provided by their generation contract significantly reduces the cost of raising capital to finance projects for developers, by stabilising revenues and assuring lenders they will be reliably paid back through the course of their loan.

The contract works by the generator selling their power onto the wholesale market, and the LCCC paying the difference between the reference price and strike price. The cost of the program is recouped by the LCCC through a levy on suppliers that is passed onto final consumers. Crucially, when the wholesale market price rises above the agreed strike price, contract holders are obliged to pay back the difference. By 2016, the ROC was closed for new projects and replaced by the CfD scheme.

2014 saw the first major reversal for the UK’s wind sector. Prime Minister Cameron declared that communities were ‘fed up’ with the aesthetics of nearby onshore wind farms, removing subsidies and restricting future project development through the Planning Act.16Oral Statement to Parliament: Statement on ending subsidies for onshore wind, 22 June 2015: https://www.gov.uk/government/speeches/statement-on-ending-subsidies-for-onshore-wind While this was not a complete prohibition, only 16 onshore turbines were approved in England between 2016 and 2020, a 96% decline over the previous five years. Thereafter, investment further concentrated on expanding offshore, and onshore wind in Scotland, where the new planning restrictions did not apply.

This subsequent period was defined by a maturation of offshore wind sector, with rapidly improving cost and performance for each CfD Allocation Round (AR), in 2012 prices – compared to, say, the Hinkley C nuclear plant at £92.5/MWh

- AR1 – 2015, 2 GW: £119/MWh17Contracts for Difference Allocation Round 1 Results: https://assets.publishing.service.gov.uk/media/5a7ffb0ee5274a2e8ab4d776/Contracts_for_Difference_-_Auction_Results_-_Official_Statistics.pdf

- AR2 – 2017, 3 GW: £74/MWh18Contracts for Difference Allocation Round 2 Results: https://assets.publishing.service.gov.uk/media/5a7ffb0ee5274a2e8ab4d776/Contracts_for_Difference_-_Auction_Results_-_Official_Statistics.pdf

- AR3 – 2019, 6 GW: £41/MWh19Contracts for Difference Allocation Round 3 Results: https://assets.publishing.service.gov.uk/media/5f566aff8fa8f5107025c055/cfd-ar3-results-corrected-111019.pdf

- AR4 – 2022, 7 GW: £37/MWh20Contracts for Difference Allocation Round 4 results: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1103022/contracts-for-difference-allocation-round-4-results.pdf

Notably, these price declines vastly outperformed forecasts made in the early days of the CfD regime. In 2011, the government set itself an “ambitious” target of reducing wind prices to £100/MWh and vastly outperformed, helping raise expectations for other nascent technologies.21Auctions for Renewable Support in the United Kingdom: Instruments and Lessons Learnt: http://aures2project.eu/wp-content/uploads/2021/07/pdf_uk_rev1.pdf

By end of decade, the United Kingdom was universally recognised as a global leader in offshore wind technology, second only to China in installed capacity. At the very top of Prime Minister Johnson’s Ten Point Plan for a Green Industrial Revolution was a plan to quadruple offshore wind generation to 40 GW by 2030, and soon thereafter committing to an emissions-free power grid by 2045.22The Ten Point Plan for a Green Industrial Revolution. HM Government, November 2020: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/936567/10_POINT_PLAN_BOOKLET.pdf Two years later, following the global energy crisis caused by Russia’s invasion of Ukraine, the British Energy Security Strategy increased the offshore wind target to 50 GW by 2030.23Policy Paper: British energy security strategy, 7 April 2022: https://www.gov.uk/government/publications/british-energy-security-strategy/british-energy-security-strategy#renewables

The tremendous value of Britain’s wind installations was thoroughly demonstrated during this crisis. Not only was renewable wind generation able to significantly lower demand for gas, but under the CfD scheme contract holders paid back over £660 million to ratepayers as wholesale prices significantly exceeded their strike price – with natural gas prices at times 9-fold higher than wind generation.24Current News, ‘Wind farms to pay back £660m under CfD scheme amid high gas prices.’ 14 March 2022: https://www.current-news.co.uk/wind-farms-to-pay-back-660m-under-cfd-scheme-amid-high-gas-prices/ The drive for energy security also revived pressure to lift the de-facto prohibition for onshore wind, but a resolution remains challenged due to ongoing grassroots opposition.

Despite – and partly because of – the sector’s success, two major challenges have arisen over the past two years:

- Inflationary and supply chain issues: the highest rates of inflation in decades are affecting the renewable sector worse than most. Beyond higher borrowing and labour costs, the industry is facing soaring prices for critical minerals and other niche components required for the latest generation of offshore wind turbines. Supply chains, from manufacturing to EPC (engineering, procurement, and construction), have been unable to keep up with the more than 10-fold growth in global demand over the past decade.

However, this is affecting not just new projects, but existing ones as well. While CfD strike prices are inflation-adjusted, this does not fully account for the sector’s 40% cost increase. As a result, developers are raising the possibility of revisiting the prices awarded in the latest Allocation Round. The urgency of the situation was recently highlighted by industry-giant Vattenfall’s announcement that they will stop development of the 1.8 GW Boreas wind off the Norfolk coast, which they were awarded in the 2022 auction.25Power Engineering International, ‘Vattenfall pulls out of Norfolk Boreas wind farm due to soaring costs.’ 21 July 2023. It is very likely that additional developers will seek an upward revision of awarded costs or abandon their projects. After 20 years of growth premised on steadily declining prices, the sector faces an uncertain commercial future.

- Permitting and grid connections: new wind and solar projects are anticipating wait times of up to 10 and 15 years to connect to the grid. The connections process, initially designed to service one or two power plant applications annually, has left National Grid unable to keep pace with hundreds of wind, solar and battery storage projects seeking a connection, with 1,100 projects worth over £200bn now in the queue.26Harriet Clough, ‘UK’s Green Energy Revolution Stalled as Billions in Projects Are Stuck in Queue’, Planning, Building & Construction Today, 2023 <https://www.pbctoday.co.uk/news/energy-news/uks-green-energy-revolution-stalled-billions-projects-stuck-queue/130342/>.

With prime offshore wind locations claimed in early Allocation Rounds, there will be additional challenges to connect new projects further afield in the North Sea.

As detailed in section 3 of this report, a number of policy initiatives are currently underway to help expedite and relieve these delays. Nevertheless, the permitting process for new infrastructure remains a major barrier, impeding and adding costs for the UK’s adoption of renewables.

These challenges have culminated in a disappointing outcome for the most recent CfD Allocation Round (AR) 5 for which the results were announced on September 8 2023. The auction was successful in attracting a record number of 95 new contracts – including the first for geothermal generation.27Contracts for Difference (CfD) Allocation Round 5: https://www.gov.uk/government/publications/contracts-for-difference-cfd-allocation-round-5-results However, it only achieved 3.7 GW of its 5 GW procurement target, which included no offshore wind capacity for the first time.

The sector cited the low maximum bid price of £44/MWh (2012 prices), which had failed to reflect the severe cost pressures cited above. Equivalent to £60 MWh at today’s prices, this is significantly lower than the current wholesale market price of £87/MWh, and the absence of new generation contracting represents a major cost to consumers and loss of momentum for the sector. The government’s priority must be to resolve these issues – such as price indexation as successfully introduced in Ireland – in advance of AR6.28Reuters, Ireland’s offshore wind prices beat forecasts despite supply risks, 15 June 2023: https://www.reuters.com/business/energy/irelands-offshore-wind-prices-beat-forecasts-despite-supply-risks-2023-06-15/

Next chapterA New Vision for Hydrogen

Hydrogen is positioned to play a similarly important but more secondary role in Britain’s net zero future. The technology was introduced second only to offshore wind in the Ten Point Plan for a Green Industrial Revolution, which called for 5 GW of low carbon hydrogen production by 2030, which was then doubled to 10 GW in the British Energy Security Strategy. There remains a fierce debate over hydrogen’s potential as an emissions-free energy carrier to decarbonise industry, transportation, heating, and much else, clouded by misinformation and antipathy from both sides.

While these medium-term opportunities are contested, there is a near-universal appreciation for hydrogen’s essential role over the long-term, with National Grid’s Future Energy Scenarios forecasting that at least 190TWh of energy for hydrogen production for the UK is required in all net zero scenarios, up to two thirds of which could be produced in Scotland.29https://www.nationalgrideso.com/document/283101/download To understand the opportunity for hydrogen to resolve the UK’s challenges, particularly with renewable intermittency and grid constraints, it is important to understand its development to the present day.

Much like wind power, Great Britain has been a historic leader in the hydrogen field, from its first production through the mixture of iron and hydrochloric acid by Robert Boyle at Oxford in 1671, to Henry Cavendish being the first to recognize it as a discrete substance in 1766, which he called ‘inflammable air.’ By 1800, Sir Anthony Carlisle and William Nicholson discovered that applying an electric current to water separated the liquid into hydrogen and oxygen gases, a process now known as ‘electrolysis’, which forms the basis of modern green hydrogen production. The author Jules Verne was only slightly ahead of his time when, writing in The Mysterious Island (1874), he proposed that “water will one day be employed as fuel, that hydrogen and oxygen of which it is constituted will be used.”

With all the future-oriented rhetoric surrounding hydrogen as essential to reaching net zero by 2050, it is easy to forget that hydrogen has already played a major role in modern industrial economies for over a century, albeit in more carbon intensive forms. This has been primarily delivered through ‘steam methane reformation’ (SMR), whereby natural gas (or another fossil fuel) is used as a feedstock and separated under high temperature and pressure into hydrogen and carbon, with the latter released into the atmosphere. A major, early use for this conversation was the Haber-Bosch process for the production of ammonia, essential for fertilisers, munitions, and plastics.

Hydrogen is deployed for ‘cracking’ in the chemicals sector, whereby complex organic molecules are broken down to create and refine petrol, diesel, jet fuel, and much else. It’s also necessary for hydrogenation to create saturated fats and candles. Up to the 1970s, hydrogen constituted half the local gas supply (through a process of coal gasification, which created ‘town gas’).30Thomas, R. (2014). ‘The History and Operation of Gasworks (Manufactured Gas Plants) in Britain.’ https://www.researchgate.net/publication/268447664_The_History_and_Operation_of_Gasworks_Manufactured_Gas_Plants_1_Written_by_Dr_Russell_Thomas_1422014 In its high-energy density liquid form, hydrogen is used for rockets and space shuttles, as well as more mundane applications such as forklifts.

Cumulatively, the world’s hydrogen demand is almost 100Mt, representing some 3% of global final energy consumption (greater than all of Germany).31International Renewable Energy Agency (May 2022), ‘Global Hydrogen Trade to Meet the 1.5°C Climate Goal: Green Hydrogen Cost and Potential.’ https://www.irena.org/publications/2022/May/Global-hydrogen-trade-Cost With more than 95% of this hydrogen production derived from fossil fuels, it’s also a major source of carbon dioxide, equivalent to approximately 2% of the world’s total emissions.32International Energy Agency, The Future of Hydrogen,June 2019 The Haber-Bosch process alone accounts for 1.4% – every 1 tonne of ammonia produced releases 1.87 tonnes of CO2.33Capdevila-Cortada, M. (2019). ‘Electrifying the Haber-Bosch’. https://www.nature.com/articles/s41929-019-0414-4#

Global Hydrogen Production by Method34IRENA Hydrogen Production by Source (as of 2021): https://www.irena.org/Energy-Transition/Technology/Hydrogen#:~:text=As%20at%20the%20end%20of,around%204%25%20comes%20from%20electrolysis.

- Natural Gas (grey) 47%,

- Coal (brown) 27%,

- Oil (black) 22%,

- Electrolysis (green) 4%,

Crucially, global demand for hydrogen as an industrial feedstock is rising at over 3% a year to keep pace with industrialisation and population growth in the developing world, not least of all for the agricultural sector.35International Energy Agency. ‘Global Hydrogen Review’ Before even considering hydrogen as an energy carrier for the net zero future, we already face a tremendous technical challenge and commercial opportunity in decarbonising this existing supply. Even the nearly 4% of production attributed to electrolysis needs improvement, as the majority of that electricity is generated through carbon-intensive coal-fired power plants in China and the developing world. Even the least ambitious pathway for hydrogen in our sustainable planet will require a 40-fold scaling in the capacity of electrolysers, fuel cells, carbon capture and storage (CCS), and other clean hydrogen infrastructure.

Of course, proponents are far more ambitious about the prospects and potential of the hydrogen economy. In the spirit of Jules Verne, the earlier boom of the late 1990s and early 2000s envisioned a major role in decarbonising transportation. Many – including President George Bush – surmised that hydrogen vehicles could displace petrol engines.36Richards, P.J. (25 May 2005), NBC News. “Bush pumps up idea of hydrogen future.” The first ‘hydrail’ – hydrogen powered train – was launched in Quebec in 2002. Honda, Toyota, Hyundai and other auto manufacturers released hydrogen fuel cell vehicles. The Great Recession and oil price collapse in 2008 proved a major blow to the sector.

Hydrogen as a Transportation Fuel

The Coalition Government’s climate strategy continued to prioritise hydrogen as a clean transportation solution, such as the UKH2Mobility scheme, mirroring the EU’s own Hydrogen Mobility Europe program.37Department for Business, Innovations & Skills (18 January 2012). “New Government and cross industry programme to make hydrogen powered travel in the UK a reality.” https://www.gov.uk/government/news/new-government-and-cross-industry-programme-to-make-hydrogen-powered-travel-in-the-uk-a-reality However, the logistical barriers and high upfront costs have proven a major challenger to consumer adoption. At present, only three passenger vehicles remain on the market – the Toyota Mirai, Hyundai Nexo, and BMW iX5. A greater number of brands have given up on the technology altogether for passenger vehicles, including GM, Mercedes-Benz, earlier pioneer Honda, and Volkswagen, the latter of which departed the sector with a white paper on the superiority of electric battery technology.38Volkswagen (12 March 2021). ‘Battery or fuel cell, that is the question.’ https://www.volkswagen-newsroom.com/en/stories/battery-or-fuel-cell-that-is-the-question-5868 These developments have helped concentrate attention on higher-value deployments of hydrogen resources.

One of these opportunities is the use of hydrogen in the aviation sector for production of sustainable aviation fuels (SAF). Great Britain enjoys a strong competitive advantage in the industry, with a wealth of advanced technology aviation firms worth some £52bn annual economic activity and the world’s third largest air transport system after the United States and China.39https://www.caa.co.uk/data-and-analysis/ Unlike personal vehicles, electric batteries are impractical for air travel given their heavy weight, which poses a severe limit on flight range and capacity. By contrast, hydrogen and derivatives, including ammonia and synthetic fuels (or e-fuels), can potentially offer a lower weight and higher power density than existing jet fuel, albeit still at low levels of technical readiness.

The sector is a major ambition for America’s Inflation Reduction Act (IRA), which sets a goal of procuring 3 billion gallons of SAF by 2030 – compared to its current annual consumption of 23 billion of conventional jet fuel today – through generous tax credits of $1.25 to $1.75 per gallon.40https://www.resourcewise.com/environmental-blog/inflation-reduction-act-sustainable-aviation-fuels-come-fly-with-me The British government’s aspirations are articulated through their ‘Jet Zero Strategy: delivering net zero aviation by 2050’ launched in the summer of 2022, after being first proposed as point six of the 10 Point Plan for a Green Industrial Revolution, with funding available through the £165m Advanced Fuels Fund.

Hydrogen for Industrial Decarbonisation

Beyond the aforementioned decarbonisation of existing grey hydrogen consumption, low carbon hydrogen will also play a greater role throughout heavy industry, particularly in applications where electrification is not capable of delivering sufficiently high temperatures. A major example is steel production, which accounts for 14.2% of Britain’s GHG from manufacturing and 2.4% of total UK emissions.41https://researchbriefings.files.parliament.uk/documents/CDP-2023-0016/CDP-2023-0016.pdf Decarbonisation of the steel industry is an important part of reaching the government’s target to achieve net-zero by 2050, and will play a key role in the low-carbon economy through the production of wind turbines, electric vehicles, energy efficient products and infrastructure.

The production of steel can reduce its carbon emissions – or potentially avoid them entirely – by using hydrogen to reduce iron ore through a process called Direct Reduced Iron (DRI). The technical process is already widely used, albeit with a natural gas feedstock instead of hydrogen. Steel plants that use methane-derived natural gas and renewable electricity for DRI emit 61% less carbon than coke-based plants, however using hydrogen in place of natural gas for DRI can reduce emissions by 97% – to just 50 kilograms per tonne of steel.42https://www.imperial.ac.uk/news/235134/greening-cement-steel-ways-these-industries/

Hydrogen can be similarly applied to cement production, another heavy-emitting industry accounting for 1.5% of the UK’s total emissions.43https://www.cisl.cam.ac.uk/files/sectoral_case_study_cement.pdf Most of the carbon emissions in cement production come from the calcination of limestone into lime and from burnt fuel. The process produces approximately 800 kilograms of CO2 per tonne of cement across an average plant.44https://www.imperial.ac.uk/news/235134/greening-cement-steel-ways-these-industries/ Hydrogen could be used to reduce the amount of clinker (the combination of lime, sand, and clay before it is mixed up with other materials to create cement) needed in cement production, as it can be used as a reducing agent in the raw material mix to reduce CO2 emissions by up to 50%.45https://commodityinside.com/hydrogen-application-in-the-cement-industry-a-promising-pathway-to-decarbonization/#:~:text=Hydrogen%20can%20be%20used%20to,emissions%20by%20up%20to%2050%25. Moreover, as three quarters of the UK’s cement demand is domestically produced, and the rest imported from the EU, the entire sector can be subject to decarbonisation policies without inducing carbon leakage.

The application of hydrogen will extend far beyond primary manufacturing. One emerging example of hydrogen for industrial decarbonisation is in Scottish whisky, an energy-intensive, heavy carbon emitting industry: Scotland’s whisky industry – the UK’s single largest food and drink export, with annual sales valued at £6.2 billion in 2022 – produces nearly 400 million litres of annually, at an estimated 2.6% of Scotland’s total CO2 emissions.46https://www.alicat.com/green-scotch/ The Scotch Whisky Association, representing 140 distilleries, set out an ambitious sustainability strategy with a commitment to achieve net zero by 2040 – five years earlier than Scotland and a decade earlier than Britain.47https://www.scotch-whisky.org.uk/insights/sustainability/

Arbikie Highland Estate, located in Lunan, 40 km from Dundee, is developing the world’s first green hydrogen powered distillery. The distillery plans to co-locate a 1MW wind turbine, which was installed in March 2023, with an electrolyser, hydrogen storage, and hydrogen boiler system to use zero-carbon hydrogen generated on-site. This project also received funding from the UK government through the Green Distilleries Competition, launched in 2020 to provide £10 million to UK distilleries for the research and development of decarbonisation strategies.48https://www.gov.uk/government/publications/green-distilleries-competition/green-distilleries-competition-phase-2-demonstration-successful-projects While still an experimental approach, projects like these and the broader scaling of local hydrogen production will stimulate further adoption of green hydrogen, as considered in the next section.

Hydrogen for Heating

A foremost challenge of the UK’s journey to net zero is the decarbonisation of residential heating. Today, over 85% of British households are heated through natural gas, one of the highest proportions in Western Europe. Accordingly, the heating sector accounts for almost a third of the UK’s annual carbon footprint, half of which is attributable to households – in other words, 17% of the UK’s total emissions are from the UK residential sector. The main source for emissions in this sector is the use of natural gas (and to a much lesser extent other fossil fuels) to heat our homes.49Department of Energy Security & Net Zero: 2022 UK greenhouse gas emissions, provisional figures, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1147372/2022_Provisional_emissions_statistics_report.pdf

With the public attention generally concentrated on renewables and their growth to nearly half the power grid, it is often overlooked that, annually, natural gas provides three times more primary energy than does electricity. Further, natural gas still accounts for some 38% of our installed capacity, while the share of generation regularly exceeds 60% during periods of low renewable output.50Energy UK: https://www.energy-uk.org.uk/insights/electricity-generation/

This resource is particularly pronounced for households, which on average consume 2,900 kWh of electricity compared to 12,000 kWh of natural gas per year.51Ofgem: average gas and electricity usage: https://www.ofgem.gov.uk/average-gas-and-electricity-usage#:~:text=Individual%20appliances%20can%20vary.,of%20gas%20in%20a%20year The difference spikes in the winter months, when natural gas can deliver five or six times more energy than electricity during cold snaps. In 2021, average household gas demand saw a low of 5 kWh/day in June and July and a peak of over 70 kWh/day for January.52Smart Energy Research Lab: Energy use in GB domestic buildings 2021, April 2022 https://discovery.ucl.ac.uk/id/eprint/10148066/1/SERL%20Stats%20Report%201.pdf

As we pursue the decarbonisation of households with heat pumps and other means of electrification, satisfying this power demand will place a tremendous burden on our already strained electricity transmission and distribution networks. It is in resolving this challenge that hydrogen can play a major role, but the specific form of its contribution remains a source of heated debate.

One potential opportunity being considered is to replace gas boilers with hydrogen boilers, which can be fuelled through Britain’s existing natural gas network, consisting of 284,000 km of pipeline connected to 29 million homes and businesses. However, the process of generating and combusting hydrogen is significantly less efficient than electric heat pumps, with over 30 academic studies endorsing the latter as a preferred choice for most heating decarbonisation, a position recently adopted by the government.53https://www.hydrogeninsight.com/policy/a-total-of-37-independent-studies-have-now-concluded-there-will-be-no-significant-role-for-hydrogen-in-heating-homes/2-1-1413043 54The Future Homes and Buildings Standards: 2023 consultation: https://www.gov.uk/government/consultations/the-future-homes-and-buildings-standards-2023-consultation/the-future-homes-and-buildings-standards-2023-consultation#performance-requirements-for-new-buildings

Even as electricity delivers the majority of emission reductions, hydrogen will likely play an important role in decarbonising residences in proximity to industrial clusters, households that are ill-suited for electric heat pumps, and a minority of other cases as will be determined by market forces and technological changes over the next three decades. However, the intensity of the public debate over this division misses the much bigger picture over hydrogen’s future potential.

As detailed above, our power grid is already strained in handling the increase in renewable generation but has not yet had to face the additional burden of growing demand, which in fact peaked in the years before the Financial Crisis at 400 TWh per annum and has gradually declined to 320 TWh today as energy intensive manufacturing operation closed down. These circumstances will change drastically over the next decade, driven by the electrification of our transport and heating sectors. While EVs will represent a major load, their ability to serve as mobile batteries will in fact help balance and stabilise the system – charging overnight during otherwise low-demand periods often marked by high wind generation, and capable of discharging their stored energy during high demand periods.

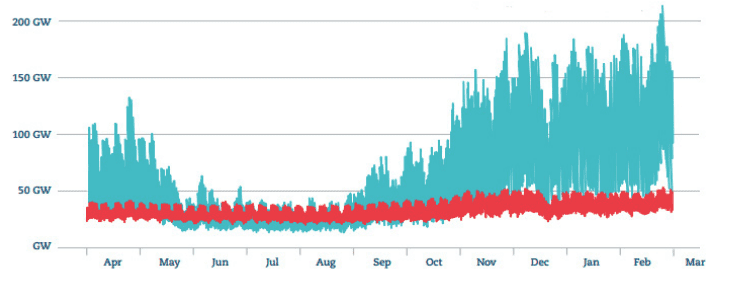

All-electric residences equipped with air source heat pumps present a very different challenge. Their electricity consumption will concentrate on cooling and heating households during summer heatwaves and winter cold spells, with the latter placing a particularly acute strain upon the system (see graphic below). The daily ratio of gas-to-electricity supply being 3.6, and rising to 7.6 for the highest hourly differential.55Wilson, G., Taylor, R., Rowley, P. “Challenges for the decarbonisation of heat: local gas demand vs electricity supply Winter 2017/2018.” UK Energy Research Centre, Aug 2018. https://d2e1qxpsswcpgz.cloudfront.net/uploads/2020/03/ukerc_bn_decarbonisation_heat_local_gas_demand_vs_electical_supply_web.pdf An entirely electric power system will require several times the renewable generation and energy storage capacity for cold winter days than will be necessary for an average day, a prohibitively costly and wasteful outcome.56Watson, S.D et al ‘Decarbonising domestic heating: What is the peak GB demand?’, Energy Policy, Volume 126, March 2019, Pages 533-544. https://doi.org/10.1016/j.enpol.2018.11.001

UK’s Energy Demand for 2017-2018 Season, peaking with the ‘Beast from the East’57UK Energy Research Centre, 2018

Blue – Gas – Red – Electricity

Compounding the issue is the inherent seasonality of these weather intensive events. While a cold spell over a single day with low-winds could feasibly be managed through battery storage, there is no possibility of doing so over the course of a week, such as the 2018 Beast from the East, which could require more battery storage than is currently deployed in the entire world today.58Conventional natural-gas fired generation equipped with CCUS will also deliver a flexible peaking resource, pending further improvements to the technology’s capture rate. Failure to prepare for this eventuality could result in catastrophic consequences with hundreds or thousands of fatalities, the least of which would be public support for achieving net zero.

This is where hydrogen can deliver its most valuable function. Excess renewable generation – particularly the autumn and spring, which are windier and experience lower power consumption – can be electrolysed into terawatt hours of hydrogen and stored in salt caverns and other geologic formations for indefinite periods of time. Whereas chemical and battery storage measure their capacity in the MWh or at most GWh range, underground hydrogen storage potential measures in the many TWhs, a thousand-fold difference. Both varieties will ultimately be required for a balanced grid, offering immediate and long-term capacity, respectively. As recognised by a landmark report from The Royal Society:

“Meeting the need for long-duration storage will require very low cost per unit energy stored. In GB, the leading candidate is storage of hydrogen in solution-mined salt caverns, for which GB has a more than adequate potential […] With the report’s central assumptions, this would require a hydrogen storage capacity ranging from around 60 to 100 TWh.”59The Royal Society, Large-scale electricity storage. 8 September 2023: https://royalsociety.org/topics-policy/projects/low-carbon-energy-programme/large-scale-electricity-storage/

When electricity demand from household heating and cooling exceeds baseload (nuclear) and variable (renewable) generation in the winter and summer months, hydrogen can be withdrawn from storage and used to fuel hydrogen-powered generating stations to satisfy this peak power demand.60Aurora Energy Research, Hydrogen can provide low-carbon flexibility to UK power system. 9 November 2022: https://auroraer.com/media/hydrogen-can-provide-low-carbon-flexibility-to-uk-power-system/

While a seemingly radical departure from the familiar nature of our existing power system, developing an energy system with hydrogen as our primary long-duration, seasonal energy storage resource is in fact the most feasible pathway to a net zero future. The most comprehensive study of this sectoral evolution, a joint research collaboration in March by Britain’s gas and electricity transmission operators, found that this integrated approach would deliver up to £38 billion of savings by 2050 compared to an isolated system.61Guidehouse, Gas and Electricity Transmission Infrastructure Outlook 2050. March 2023: https://energycentral.com/system/files/ece/nodes/602830/gas_and_electricity_transmission_infrastructure_outlook_2050_-_final_report_-_mar_23.pdf

Hydrogen for Export

Its potential to address seasonal demand fluctuations also accounts for Britain’s tremendous potential as a major hydrogen exporter. Europe will struggle to deliver summer and winter peak demand with the phase-out of unabated natural gas heating and generation, and is similarly looking to hydrogen as an emissions-free flexible resource. With a concentration of heavy industry, northwestern Europe – Germany and Benelux – is anticipating high levels of demand in excess of their relatively meagre renewable energy generation potential.62WaterstofNet Vzw, Cross-border hydrogen value chain in the Benelux and its neighbouring regions. February 2023: https://www.benelux.int/nl/etude/cross-border-hydrogen-value-chain-in-the-benelux-and-its-neighbouring-regions/ The EU’s REPowerEU plan envisions importing up to 10 million tonnes of renewable hydrogen from outside of the Union by 2030.63European Commission, REPowerEU. 18 May 2022: https://commission.europa.eu/publications/key-documents-repowereu_en This could be supplied from Britain through existing natural gas pipeline transmission infrastructure, with upgrades to handle hydrogen.

However, the opportunity will not wait for us indefinitely. Many countries around the world are pursuing hydrogen export opportunities, with high ambitions amongst legacy fossil fuel producers in North Africa and the Middle East, who hope to leverage their existing hydrocarbon infrastructure to capitalise on opportunities in Europe. Morocco and Egypt, aiming to take advantage of their abundant solar irradiation and wind intensity, have signed MOUs with the European Commission to explore developing a hydrogen trade, as well as enlisting in the broader African Green Hydrogen Alliance with members further afield, including Namibia and Mauritania.64Atlantic Council, Realizing North Africa’s green hydrogen potential. 2 February 2023: https://www.atlanticcouncil.org/blogs/energysource/realizing-north-africas-green-hydrogen-potential/

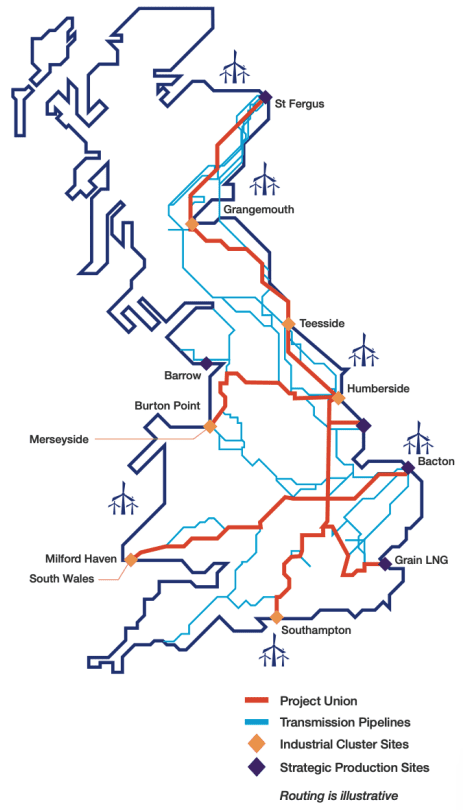

The UK’s primary vehicle for realising these medium-term export opportunities, and scaling our own domestic hydrogen ambitions, is the Project Union initiative by National Gas Transmission (NGT). The scheme would see 2,000 km of existing natural gas transmission pipelines upgraded to connect hydrogen production centres with large industrial clusters and offtakers, as well as existing LNG terminals and interconnectors for transhipment beyond the UK.65National Gas, Project Union Launch Report. May 2022: https://www.nationalgas.com/document/139641/download Ofgem approved funding for the feasibility study with £5.626m from the Net Zero Pre-Construction Work and Small Project (NZASP), aiming for completion by the mid-2030s.66Ofgem, NGT Project Union Feasibility Phase – Decision. 25 April 2023, https://www.ofgem.gov.uk/publications/ngt-project-union-feasibility-phase-decision

The project is considered to be the future ‘backbone’ of the UK’s hydrogen economy, ongoing support for this which will be essential to realising the UK’s decarbonisation targets and maintaining our competitiveness in the climate economy. In reflecting upon the challenges and mounting costs of underbuilding our electricity transmission capacity during the scaling of our renewable generating capacity, it is vital that we right-size our hydrogen delivery and storage infrastructure strategy from the onset to achieve net zero.

The government of Scotland has outlined additional ambitions and export pathways for Scottish hydrogen production. Beyond existing and future pipeline connections, Holyrood has detailed opportunities for marine vessel transportation of liquid hydrogen, green ammonia and methanol, and Liquid Organic Hydrogen carrier (LOHC) to reach customers in the Netherlands and Germany, noting the competencies of Scotland’s port facilities and legacy energy infrastructure.67Scottish Government: Hydrogen action plan – The Renewable Hydrogen Export Opportunity, 14 December 2022: https://www.gov.scot/publications/hydrogen-action-plan/pages/6/ These plans would be realised through a series of regional initiatives that will connect to Project Union, such as the three projects led by SGN currently undergoing pre-FEED studies (in both Scotland and Southern England).68SGN, SGN and NGT accelerate hydrogen plans for Scotland and southern England, 23 March 2023: https://www.sgn.co.uk/news/sgn-and-ngt-accelerate-hydrogen-plans-scotland-and-southern-england

Next chapterScale of Opportunity

Leveraging Great Britain’s growing volume of curtailed renewable generation would provide substantial benefits through a more efficiently deployed energy system, better value from consumer energy bills, supporting economic opportunities in rural and remote communities, and accelerating development of vital net zero technologies.

The forecasting below was conducted by LCP Delta, a leading consultancy within the energy sector, deploying LCP Delta’s Central Scenario using its proprietary EnVision model and LCP Delta’s Hydrogen Intelligence Service. These calculations are based on production through Proton Exchange Membrane (PEM) electrolysis at 70% efficiency, a conservative estimate of the steadily improving industry standard.69IRENA, Green Hydrogen Cost Reduction: Scaling Up Electrolysers to Meet the 1.5°C Climate Goal, 2020: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Dec/IRENA_Green_hydrogen_cost_2020.pdf

Graph 1: Annual Renewable Generation Curtailment

Graph 2: Annual Curtailment as Hydrogen Production (TWh)

It requires approximately 50 to 55 kWh of electricity to electrolyse 1 kg of hydrogen. As technology improvements deliver more efficient outcomes over the decade, curtailed renewable generation would be sufficient to deliver the following:

| Year | Production Potential (TWh) | Production Potential (tonnes) | Electrolyser Capacity (MW)70Operating 30% of hours per year |

| 2022 | 4.678 | 118,731 | 3,560 |

| 2023 | 5.241 | 133,020 | 3,989 |

| 2024 | 8.785 | 222,970 | 6,686 |

| 2025 | 12.823 | 325,457 | 9,759 |

| 2026 | 16.724 | 424,467 | 12,728 |

| 2027 | 17.123 | 434,594 | 13,031 |

| 2028 | 16.256 | 412,589 | 12,371 |

| 2029 | 17.964 | 455,939 | 13,671 |

| 2030 | 14.627 | 371,244 | 11,132 |

The curtailment figures steadily increase through the middle of the decade and peak in 2029 before declining in 2030. This reflects the anticipation of new constraint management solutions reaching operation, including the scaling of energy storage, demand management, and indeed new electrolyser capacity as detailed in this report.

The economic potential of this curtailment volume as hydrogen output is substantial, with the 456,000 tonnes in 2029 equivalent to two-thirds of the UK’s approximate 700,000 tonnes of grey hydrogen consumption in 2020, the largest destinations for which being chemical production, oil refining, and fertiliser.71House of Commons, Science and Technology Committee, The role of hydrogen in achieving Net Zero. 14 December 2022: https://committees.parliament.uk/publications/33292/documents/180198/default/ Alternatively, leveraging curtailment for green hydrogen production would allow for the decarbonisation of other hard-to-abate sectors. As detailed in the proceeding section, two of the most prominent examples include decarbonisation of steel manufacturing and production of sustainable aviation fuels.

| Rationale for electrolysis MW capacity |

| Given electrolysers will be making use of excess renewable electricity, that would otherwise be curtailed, low utilisation factors are likely. These rates could be improved by providing a hybrid system with a battery, which could smoothen out the electricity produced by the renewable generator, hence reducing the required electrolyser capacity. A grid connection could also increase the running hours of the electrolyser, as envisioned in the next section.

For this calculation, we have assumed all electricity is provided by direct connection to renewable generators which would otherwise have curtailed their electricity production. Electrolyser utilisation factors of 15% were used as an approximation to the duration of these curtailment events. If up to ~30% utilisation factors could be possible, this would mean around half of the running hours from wind farms (typical capacity factors around 60%) could be used for hydrogen production - reducing the electrolyser capacity required to produce the same volumes of hydrogen. Alternatively, the peak curtailed renewable electricity volume for a given hour could help size the maximum electrolyser capacity required to utilise all the curtailed electricity without the use of batteries. |

Graph 4: Green Steel Production potential

‘Green Steel’ using direct reduced iron (DRI) with an electric arc furnace (EAF) is steadily emerging as the leading option for net zero compatible steel production. Traditionally, steel has been produced in a blast furnace with coke – a carbon-intensive fossil fuel – to generate 1,200 °C heat to melt iron ore pellets, the liquid of which is mixed with scrap metal. A climate-friendly alternative is to use hydrogen to generate a lower heat of 800 °C to reduce iron pellets into sponge iron, which can be processed into conventional steel. The industry average is 50 kg of hydrogen to produce one tonne of steel.

To illustrate a potential use factor for curtailed wind generation, this table shows the tonnage of green steel manufacturing which could be achieved if the entire volume of curtailed wind generation was committed to hydrogen power DRI steel production. In practice, usage would be spread across different sectors. By 2026, this potential exceeds the 7m tonnes of total steel production Britain achieved in 2019.

| Year | Steel Production (tonnes) | Share of Current Production (7m) |

| 2022 | 2,374,619 | 33.9% |

| 2023 | 2,660,406 | 38% |

| 2024 | 4,459,391 | 63.7% |

| 2025 | 6,509,137 | 92.9% |

| 2026 | 8,489,340 | 121.2% |

| 2027 | 8,691,878 | 124.6% |

| 2028 | 8,251,777 | 117.8% |

| 2029 | 9,118,782 | 130.2% |

| 2030 | 7,424,873 | 106.1% |

Graph 5: Sustainable Aviation Fuel

The UK is well-positioned to become a world leader in the future of sustainable aviation, an industry that is currently responsible for 2.5% of global emissions. The government has laid out major ambitions in its Jet Zero strategy, including commitments to develop at least 5 commercial-scale SAF plants in the UK by 2025, mandating at least 10% of all jet fuel to be SAF by 2030 – of which the UK currently consumes 12.3m per year, and achieving a net zero sector by 2040.72Department for Transport, Pathway to net zero aviation: Developing the UK sustainable aviation fuel mandate. March 2023: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1147350/pathway-to-net-zero-aviation-developing-the-uk-sustainable-aviation-fuel-mandate.pdf

Hydrogen’s lightweight and high energy density is highly favourable for use as SAF, whether through liquid hydrogen or its conversion into a green synthetic fuel, for which there are a variety of emerging technical processes. If the UK’s curtailed renewable energy was electrolysed and committed to SAF production, it could achieve up to 92.9% of our 2030 target.73LCP Delta Hydrogen Intelligence Service

| Year | SAF Production (tonnes) | Share of 2030 target |

| 2022 | 297,694 | 24.2% |

| 2023 | 333,521 | 27.1% |

| 2024 | 559,051 | 45.4% |

| 2025 | 816,017 | 66.3% |

| 2026 | 1,064,265 | 86.5% |

| 2027 | 1,089,656 | 88.6% |

| 2028 | 1,034,483 | 84.1% |

| 2029 | 1,143,175 | 92.9% |

| 2030 | 930,818 | 75.6% |

Putting the System to Work

There are a variety of potential arrangements that would allow the aforementioned curtailed wind generation to be redeployed for green hydrogen production. The technical and commercial configurations detailed below are oriented towards the existing circumstances above the B6 boundary in Scotland, but are intended to be applicable with minor modifications across any region of the UK that will experience rapid growth of wind generation capacity over the medium-term, most particularly Wales and East Anglia.

The inputs for electrolysis require minimal space, but must have a reliable source of water as it takes 9 litres of freshwater to produce 1kg of hydrogen. From an environmental sustainability perspective, this is a critical factor that must be integrated into our system planning to ensure that decarbonisation of our power system does not come at the expense of our ecosystems. Recent studies have found that achieving Scotland’s ambitious 2045 hydrogen production target of 25 GW could account for up to 6% of total raw water and 13% of total potable water consumption.74SGN, Feasibility Study into Water Requirement for Hydrogen Production. November 2022: https://smarter.energynetworks.org/projects/nia2_sgn0014/ This compares to a total industrial consumption of 22% of all Scotland’s treated water.75Allan, Grant J. et al, Environmental Science & Policy. Scotland’s industrial water use: Understanding recent changes and examining the future. Volume 106, April 2020, pages 48057.

A growing hydrogen sector could also help attract investment into effluent water treatment and desalination facilities, further reducing any potential environmental pressures. This outcome compares highly favourably to other potential sources of major hydrogen production in North Africa and the Middle East, regions which already suffer from severe and growing water shortages.

Electrolysers also require a reliable source of power, and therefore can be located in one of three location-types, with several variations:

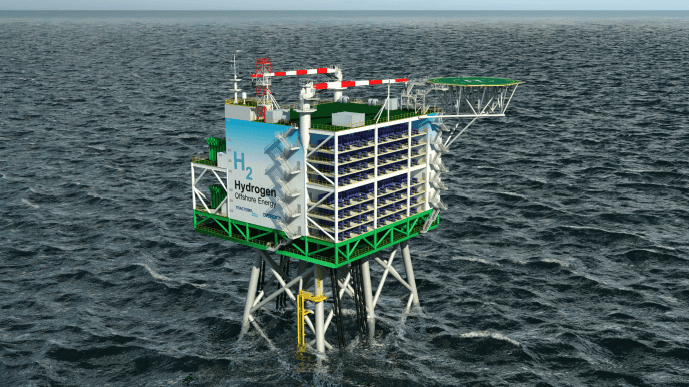

- Onshore Behind-the-meter (BTM): the electrolyser would be located in immediate adjacency to an onshore wind farm, ‘behind’ the farm’s connection to the power grid. When ‘deemed to dispatch’ the electrolyser would draw power directly from the wind turbines’ generation (image 1). As further detailed in the commercial arrangements section below, the electrolyser would likely have a separate grid connection to intake power from the grid outside of curtailment events.