Gerard Lyons

Senior Fellow

This positive message was also underlined by the Chancellor at the Mansion House, where he delivered his annual keynote speech to the City. This signalled an important moment for financial services. If there was any doubt about the Government’s support for the City, then the Chancellor not only quelled those fears but confirmed that a vision is emerging in which financial services have a pivotal role to play. Levelling up is not about holding back the City but allowing it to prosper too.

It was also a week that highlighted the challenges confronting monetary policy as we emerge from the pandemic, with conflicting messages from the Bank of England’s outgoing chief economist Andy Haldane and the Governor, Andrew Bailey, whose Mansion House speech focused on the uncertainties impacting the inflation outlook.

Balanced growth

The UK is an imbalanced economy. It has cutting edge sectors and firms, but also a large number who work in low skill, low pay and low productive jobs. The imbalances are not simply in place – London versus the rest, urban versus rural and coastal versus inland – but in a multitude of other areas – including skilled versus unskilled workers and access to training, home owners and renters, and even large versus small firms that includes the ability to access finance easily and cheaply.

Levelling up was also the focus of a speech given by Andy Haldane to Policy Exchange at the start of the week. In this he outlined the foundations of levelling up as including the scale and longevity of investments, transport and digital infrastructure, universities and innovation, skills and also collaboration between government, business and residents.

In this context, it was thus good to see the Nissan announcement. The fact that the Government provided a subsidy should not be viewed as the new normal, or undermining the announcement’s significance, but rather the reality of this policy area where China, Japan and South Korea lead in such battery technology and that governments across western Europe are reaching out with large subsidies to attract such gigafactories.

Not only is this investment in Sunderland a positive in its own right, but it also has wider strengths in terms of the regional supply chain. It will lead to increased localisation, with higher local content and it signifies how we have embraced the mindset that the green agenda goes hand-in-hand with a pro-growth policy. That latter point is important as the UK moves towards net zero, a necessary and ambitious but also an expensive aim that needs to be managed carefully. This is part of a broader industrial revolution, helping underpin huge investment and infrastructure, with high paid jobs around the country.

Yet the focus cannot be solely on levelling up, as important as that is. The UK’s economic challenge is that its trend rate of growth is too low, having been revised down sharply in the aftermath of the 2008 global financial crisis. There is no precise agreement on this number, but it has been reduced from around 2.25% before 2008 to 1.3%, or so, now. Hence the importance of a clear economic vision and strategy, and galvanising the private sector, to help raise this trend rate. A similar problem confronts countries cross western Europe, the slow growth region of the world economy.

Focus on the City

One question, perhaps, is how can the UK ensure its world beating financial sector continues to prosper and help ensure that this challenge of raising the UK’s growth rate becomes an opportunity?

The Chancellor hit the right tone in his Mansion House speech. Although high level, it was rich in content and released alongside it was a policy document outlining a new chapter for financial services. Both the speech and accompanying Treasury paper outlined an open, green and technologically advanced financial sector. The focus is on being an open and global financial hub, at the forefront of technology and innovation, a world leader in green finance and creating a competitive marketplace, effective in the use of capital. Ambitious, yes, but realistic too. Specifics noted included a raft of areas such as delivering an outcome based mutual recognition agreement with Switzerland, promoting high international standards on financial stability, innovation and sustainability and targeting high skilled visa reforms.

One paragraph of the Chancellor’s speech captured this well, with the message that, “We need a plan for our most global industry – financial services – which sharpens our competitive advantage while acting in the interests of our citizens and communities.” Encouragingly, this message was very much in line with that of our recent Policy Exchange strategy paper on the City and financial services, specifically that the City is an important tool in delivering on the levelling up agenda and that this can be achieved while simultaneously increasing the City’s competitiveness. This was equally echoed in the accompanying call by the Treasury for future consultation with the City in order to achieve this aim. Importantly, listening to the practitioners will help this policy evolve in the right way.

The changing global dynamics

The pandemic will have a lasting influence, in many ways, including a renewed focus on the green agenda. Also, as we emerge from the pandemic, it is easy to overlook that two of the dominant pre-pandemic influences on the global economy look set to re-establish themselves: the shift in global economic power to the IndoPacific and the technological, digital and data revolution. Both were central to appreciating the significance of the Chancellor’s message.

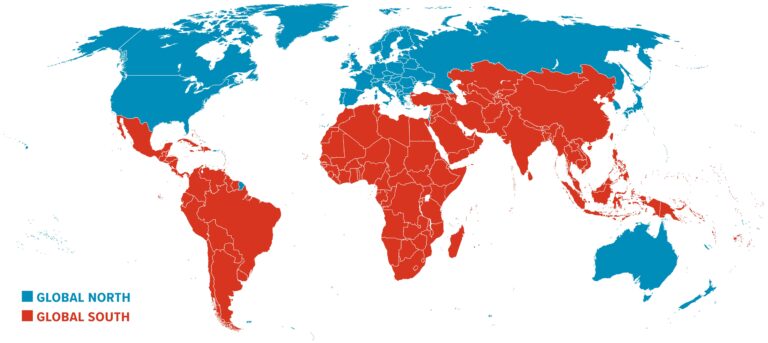

There is a shift in the balance of power to the Indo-Pacific, a region stretching from India in the west to the US in the east. The Trans-Pacific, in contrast to the Trans-Atlantic that dominated the post war period, is emerging as the more important region in geopolitical and economic terms. As the work of Policy Exchange’s recent IndoPacific Commission has demonstrated, the UK needs to reposition itself in this changing economic and geopolitical dynamic. The Chancellor echoed this, citing in his speech this week’s new deal on financial services between the UK and Singapore and the need for a “mature and balanced” relationship with China.

Being at the forefront, too, of the other pre-crisis trend, the technological revolution, is vital for Britain’s and the City’s success, underpinning another key element of the Chancellor’s message.

Three key take-aways

In my view, three key underlying take-aways emerged from Rishi Sunak’s speech: the strong, supportive message from the Chancellor towards the City; a clear aim to boost the City’s competitiveness; and the need for the City to engage with and actively support the wider economy.

First, was the clear signal from the Chancellor that he and the Government are engaged with the City. This reflects an evolution from the aftermath of the Referendum and the political crisis of 2017-19 that triggered tremendous uncertainty and a far from conducive backdrop for firms in the City. While the City continued to grow and prosper during this time, firms in the City, naturally, had to plan according to their business model and that period of benign neglect led to a small shift in some business to other financial centres such as Amsterdam, Paris, Dublin and Frankfurt.

Yet, across Whitehall and Westminster there seemed little awareness of the poor global image that was being conveyed about the City. Now, the pressure is on the Chancellor, to restore it, underpinned by a necessary strategy.

It is time for the UK to provide a clear, positive message globally that changes the terms of the debate, which is too often pessimistic and wrong about the City’s prospects. This will allow firms to make future plans based on a surer footing about the policy aims of the Government.

The Chancellor confirmed that the UK will not be offered equivalence. This is indicative of a politically motivated approach that the EU appears to be adopting towards the City of London. While equivalence would be a nice to have, its absence confirms the direction of the travel that the UK should and will take. Namely, regulatory divergence and a focus on boosting its competitiveness in the face of challenges from New York and emerging centres across Asia.

That led to the second key takeaway from the Mansion House: London’s competitiveness. The focus on green and technology is indicative of the need for London to be at the forefront of growth areas. London’s global success depends upon its inherent characteristics, the regulatory environment and being “the” place where clients want to conduct business because of its liquid, deep and broad markets.

In the 1960s, the UK was able to take advantage of uncompetitive tax policies by the US, to establish London as the global centre for the euro-dollar, where in those days euro meant international. Now, likewise, with the EU apparently intent upon building a protectionist walled garden around its financial sector, London can ensure that it thrives in the modern-day version, the euro-euro market, as the home for parallel markets in euro denominated securities. A competitive City, underpinned by a supportive policy approach, will continue to thrive as Europe’s dominant financial centre – and by a long-way – and as a global hub.

The third, crucial, takeaway was the inevitable engagement of the City with the wider economy and working for all its citizens. The Chancellor’s focus on cash was particularly relevant and highlights a wider issue about the need for greater financial inclusion. There are many more issues here that merit attention, including addressing the Macmillan Gap that was identified by a Parliamentary committee as long ago as 1931 about the need to address the financing needs of small to medium sized firms.

Inflation threat

This positive overall message from the Chancellor, embracing a wide array of issues, has to be seen, also, in the context of where we are in the economic cycle.

The UK still needs a market friendly, pro-growth economic strategy based on the three arrows of a: credible supply-side agenda built upon investment, innovation and the incentives of low taxation and smart but not burdensome regulation; a credible fiscal strategy aimed at reducing the debt burden; and a credible monetary policy alongside financial stability.

The danger is that each of these arrows is missing the bullseye.

The immediate challenges are most apparent in fiscal and monetary policy. Hence the importance of the Governor’s speech at the Mansion House. Over the last decade, monetary policy has contributed to rampant asset price inflation and to resulting growing asset and wealth inequality. It is important that monetary policy does not feed more widespread inflation now.

The UK is rebounding strongly and looks set to return to its pre-pandemic level before the end of the year. While this is welcome, the Governor was keen in his Mansion House speech to point out that this would leave the economy having still suffered two years of lost growth, relative to pre-pandemic expectations. Yet, it was only a few months ago that the Bank thought the economy would not return to this level until the end of next year; now it sees this as achievable this. Avoiding premature policy tightening was the Governor’s message, echoing the view emanating from the US.

Inflation is rising. Will this pass-through, persist, or become permanently entrenched? Pent-up demand and supply bottlenecks are contributing to higher inflation and, in the view of the Governor this will be temporary.

While important that the post-pandemic rebound is not chocked off by premature policy tightening, it is also vital it is not undermined by inflation that persists, forcing more aggressive tightening later. The decision on when to tighten policy is a judgement call. I certainly do not see inflation becoming permanently entrenched, but excessively loose monetary policy risks inflation not passing through where it returns to 1% to 2% but persisting, around 3% to 4%. It will certainly spike higher over the coming year.

I would advocate a calm, measured monetary response, and not panicking, with a gradual, predictable and immediate tightening of monetary policy. The exit strategy would mean halting the printing of money through quantitative easing, and eventually reversing it; this would delay raising interest rates until later, when the economy is stronger. This, too, would help avoid forcing premature and unnecessary fiscal tightening. The last year has highlighted the interconnectivity between monetary and fiscal policy.

Conclusion

It was an important and positive week for UK policy. Ideally there is a need for Nissan’s investment to be replicated elsewhere, by others, across the UK. There is a need for monetary policy to evolve further. And, crucially, the Chancellor’s message at the Mansion House highlighted the opportunities for the City and the need to play to our strengths, for financial services to support the levelling up agenda and to help reposition the UK to grow strongly in the changing global economy.

Gerard Lyons is a senior fellow at Policy Exchange