The Green Deal was launched in 2013 as the Government’s flagship energy efficiency programme, with an aim to deliver energy efficiency improvements to “millions of households and businesses”, in order to tackle both greenhouse gas emissions and energy costs. Lord Barker, the scheme’s architect, once described it as “the biggest home-improvement programme since the Second World War.” However, the scheme failed to live up to these very high expectations, providing 16,000 loans worth a total of £50 million in its first two years of operation, and the Government withdrew its support for the scheme in 2015.

The case for improving energy efficiency remains very strong. As discussed in our report, The Customer is Always Right, improving energy efficiency is amongst the cheapest ways to decarbonise our energy system. Our report, Too Hot to Handle?, argues that in order to decarbonise heating, it is essential that we first improve the thermal efficiency of our buildings and heating systems. Improving energy efficiency also helps to reduce energy bills: analysis suggests that a more ambitious approach to household energy efficiency could lead to a saving of £9 billion per annum on household energy bills. It is also the most effective way to tackle fuel poverty and the adverse health effects of living in cold homes, as discussed in our report, Warmer Homes.

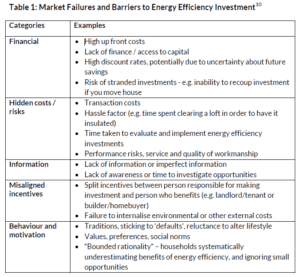

However, whilst the case for investing in energy efficiency is strong, there are many barriers which prevent households and businesses from doing so, as identified in our 2016 report, Efficient Energy Policy:

The Green Deal was supposed to address a number of these barriers. It provided information to households on cost-effective energy efficiency measures in the form of Green Deal Assessments (over half a million of which were carried out). It addressed the barrier to finance through the provision of energy efficiency loans and grants, and addressed the ‘split incentives’ between landlords and tenants by allowing energy efficiency investments to be paid back through the occupant’s energy bill.

However, the scheme had a number of defects which limited uptake, as identified in our report, The Customer is Always Right. The scheme was poorly marketed, in part due to the fact that the Green Deal Finance Company was prevented from marketing its products directly to end consumers (due to its status as a debt administrator). Instead, Green Deal loans were marketed through a network of approved energy efficiency installers, many of whom were not used to selling financial products. The process of becoming an approved Green Deal supplier was highly bureaucratic, taking 6-9 months and costing around £20,000.

Customers were also put off by the complexity and bureaucracy of the scheme. The process of obtaining a loan could take weeks, and loans were limited to energy efficiency investments which achieved a certain level of payback, as defined by the so-called ‘Golden Rule’. The loan rate of around 8% APR was unattractive to some households: it compared favourably to unsecured loans or credit card finance (which can have an APR of 10%+) but was relatively unattractive compared to other forms of finance such as mortgages.

That said, there are several positives which can be taken from the experience of the Green Deal to date. The architecture to attach energy efficiency loans to household energy bills is now in place and working effectively. Attaching loans to energy bills is attractive from the loan provider’s point of view, since the default rate on energy bills is extremely low (at around 3%). This reduces the cost of borrowing for the loan provider, and this saving can be passed on to the end customer. It is also clear that Green Deal loans were attractive for certain groups of households – particularly those on lower incomes or with a lower credit score – for whom unsecured finance was otherwise unavailable or very expensive. Green Deal loans could therefore play an important role in improving energy efficiency for households at risk of falling into fuel poverty.

The Government recently sold the Green Deal to private sector investors Greenstone Finance and Aurium Capital Markets, who are aiming to revamp and re-launch the scheme later this year. Policy Exchange held a roundtable last month to discuss the next steps for the scheme, which suggested a number of ways to address the shortcomings identified above, as follows:

- Simplify the Route to Market: There is significant scope to streamline the process of obtaining a Green Deal loan. It previously took weeks to get approval for a Green Deal loan, compared to minutes for alternative forms of finance such as an unsecured loan. The newly acquired Green Deal Finance Company is looking to streamline the process for approval of Green Deal loans to less than a day.

- Improve the Customer Proposition: one of the flaws with the original Green Deal, was that it was marketed almost entirely on the basis of energy bill savings. Some households may invest in energy efficiency based on the identified energy savings alone, but the reality is that this is not an attractive proposition to many households, due to the non-financial barriers identified above. Households are more likely to invest in energy efficiency if they can see that this will improve the warmth or comfort of their home, and/or increase its value. There is an opportunity for the new Green Deal Finance Company to improve its customer proposition to improve its appeal.

- Address Information Asymmetry: One of the major barriers to investment in energy efficiency is a lack of information available to end consumers on whether it represents good value for money. This reflects a general lack of reliable benchmark prices for energy efficiency products (such as insulation and new boilers) and a level of mistrust about whether energy savings will actually be realised in practice (which reflects concerns over the quality of installations and relative performance of specific products). The new Green Deal Finance Company is seeking to address these issues to improve the consumer experience. They plan to provide price benchmarks for a range of products to ensure that households taking out a loan are getting a good deal. They will address the concerns regarding quality by performing random checks on a sample of installations, putting in place stringent requirements for prospective installers and only working with approved quality installers.

- Reduce complexity: As identified above, one of the problems with the original Green Deal scheme was the complexity and bureaucracy associated with the ‘Golden Rule’. The Golden Rule has merits in that it provides a degree of customer protection; but it also had downsides as it prevented some energy efficiency projects from being financed. The new owners of the Green Deal Finance Company plan to address this by developing additional loan products alongside the original Green Deal model. This could mean that the ‘Golden Rule’ becomes an ‘opt out’ rule – in line with one of the key recommendations from our report The Customer is Always Right. Loans would still be subject to consumer credit rules to prevent mis-selling.

Provided these points are addressed, the revamped Green Deal has the right ingredients to be a success going forward and to deliver energy efficiency improvements to a large number of households and businesses around the UK. The Green Deal provides a mechanism for households to invest in the efficiency of their home, at no cost to the taxpayer. It is not a silver bullet, but should be seen as part of a wider package of mechanisms to improve energy efficiency. In Efficient Energy Policy, we argue that in order to make more significant progress, energy efficiency needs to be ‘structurally embedded’ into the housing market. The report makes a number of recommendations, including that Government should link Stamp Duty to the energy performance of homes and reform mortgage affordability tests such that they more accurately reflect the energy efficiency performance of a home. Taken together, these proposals could mean that there is a premium for more energy efficient homes, which in turn would encourage more households to improve the efficiency of their home. Combined with a new and improved Green Deal focused on increasing consumer engagement, we may finally start to see more interest in energy efficiency amongst households.