In May, I wrote a blog to the new Secretary of State for Energy & Climate Change, Amber Rudd. It highlighted the possibility that the Levy Control Framework (LCF), which controls spending on renewable energy subsidy schemes, may have already been spent to 2020. DECC had previously estimated that there could be £1 billion left in the pot to 2020, in which case they could continue to fund new low carbon projects. However, my blog identified a number of factors that have changed in recent months, which in total indicate that the LCF has already been fully allocated to 2020.

But new government forecasts released yesterday suggest that the situation may be even worse than I first thought. Media reports in the run up to yesterday’s budget suggested that analysis of the LCF would be contained in the budget. The numbers were in fact contained in the Economic and Fiscal Outlook produced by the Office for Budgetary Responsibility (supplementary table 2.7).

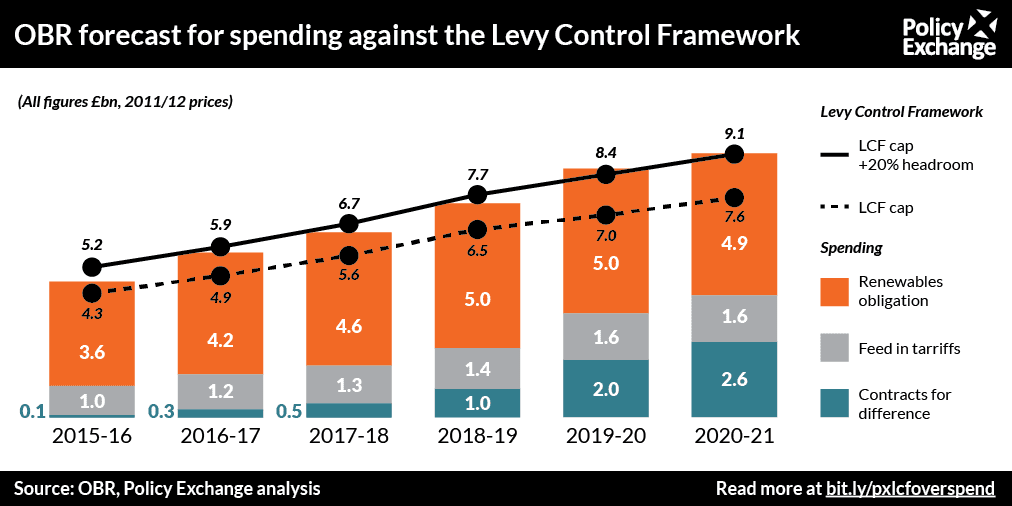

This shows that the total spending on renewables subsidies such as the Feed in Tariff, Renewables Obligation and Contract for Difference, could increase to £11.5 billion in nominal terms by 2020/21, or £9.1 billion in 2011/12 prices once inflation is taken into account. (Note: for the economists out there – I’ve used RPI inflation for the FIT and RO, and CPI for the CfD).

Given that the cap on the LCF is set at £7.6 billion in 2020/21 (in 2011/12 prices), this means that spending on renewables subsidies could be 20% over the cap by 2020. This not only means that the LCF budget is fully allocated, but that the 20% ‘headroom’ which HM Treasury created to allow for any overspend, has already been spent too.

The implication of these new forecasts is that DECC is likely to significantly overshoot agreed spending limits on renewables policies funded through consumer bills. If the OBR’s forecasts are correct then this would add an additional £20 per household by 2020 on top of the increase that DECC is already assuming.

What is also striking about these figures is the massive upward revision in spend compared to the previous set of forecasts (OBR Economic and Fiscal Outlook, March 2015). The previous forecast for LCF spending to reach £7.9 billion in 2019/20 has now been revised up to £10.3 billion (both in nominal terms), an increase of 30%.

The OBR has provided limited details on why these numbers have changed. Our own analysis suggests that part of the difference can be explained by the continued rapid take-up of the Feed in Tariff, the fall in wholesale prices (which increase the level of subsidy under CfD contracts), , and higher than expected output from offshore wind farms (i.e. previous assumptions were far too conservative). The rest of the difference presumably relates to higher than expected deployment under the Renewables Obligation: we now know that 2.5GW of solar PV projects built out in the first quarter of 2015, much of it under the RO just before it closed to solar. It may also be that the OBR’s figures include additional projects beyond those already committed.

Government will need to take time to digest these figures, but the implication is that it now needs to take radical steps to stem the increase in policy costs, and find more cost effective ways of meeting policy objectives.

This will be painful reading for the renewables industry, but it looks like the renewables subsidy party is well and truly over…