- Policy Exchange analysis reveals that hitting carbon targets will leave a £9-23 billion p.a. hole in forecast tax receipts by 2030.

- Government needs a new joined-up strategy to clean up road transport: different departments are currently using different forecasts.

- Official estimates of vehicle emissions and fuel efficiency are highly misleading.

- Electric charging infrastructure must be ‘smart’ in order to avoid network and power system issues.

In a major new report released today, Driving Down Emissions, we argue that the Government must take more assertive action to tackle the twin problems of greenhouse gas emissions and air pollution from road transport.

Overall, the UK is making significant progress to reduce greenhouse gas emissions – having achieved a 38% cut in emissions since 1990. However, the greenhouse gas emissions from road transport have remained stubbornly high, and actually increased by 1% since 1990. Alongside this, the UK continues to have a significant problem with urban air pollution – as highlighted in our previous report Up in the Air. Nitrogen Dioxide levels exceed legal and healthy limits in Greater London and 74 other local authorities across the country.

Whilst new vehicles are getting cleaner and more efficient, we are driving them more: motorists drove a total of 320 billion vehicle miles in Britain in 2016 alone. Van traffic has increased by 89% since 1990, in part due to the growth in home deliveries and online shopping.

Technology Options

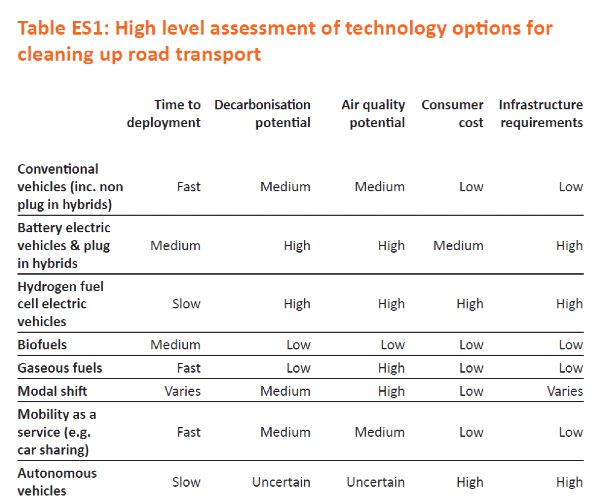

Our report provides a review of the full spectrum of options available to clean up road transport – from new technologies like electric, hydrogen and natural gas vehicles, to making conventional vehicles cleaner and more efficient and encouraging people to take public transport. We have considered the decarbonisation potential, consumer cost, and infrastructure requirements associated with each of these options. In our view the Government needs to pursue a technology-neutral approach to cleaning up road transport, considering the range of options available.

Fiscal Challenges

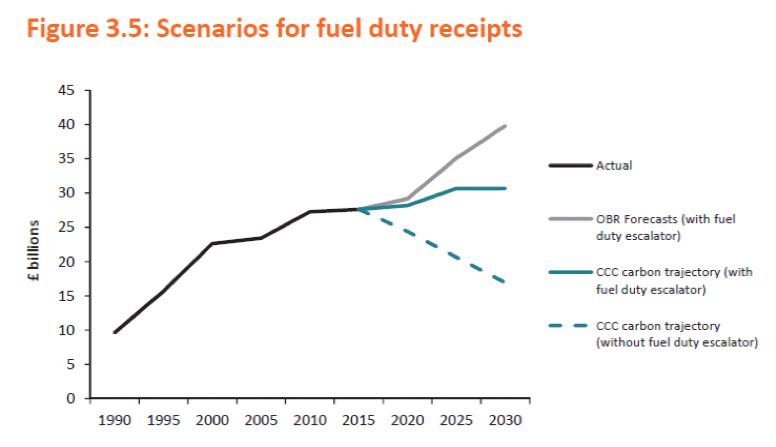

One of the striking findings in our report is that cleaning up road use could create significant fiscal challenges in the future. At present the Treasury raises £28 billion from fuel duty and a further £6 billion in road tax each year. Switching away from conventional vehicles towards low emission vehicles could result in a significant drop in tax receipts.

It appears that the Government has failed to appreciate the magnitude of this change. Long-term forecasts by the Office for Budgetary Responsibility suggest that fuel duty receipts will increase from the current £28 billion per year to reach circa £40 billion by 2030. However, Policy Exchange analysis suggests that if we meet legislated carbon targets, then fuel duty tax receipts would actually be £17-31 billion in 2030 – or £9-23 billion lower than the OBR is assuming. The cumulative impact on fuel duty receipts could be as much as £170 billion between now and 2030.

One of the reasons for this discrepancy is that the OBR and Department for Transport are working off completely different projections for road transport emissions than the Committee on Climate Change. None of DfT’s scenarios achieve the emissions targets suggested by the Committee on Climate Change.

A new strategy to clean up road transport

Our report finds that there is no overarching strategy to deliver the required reductions in vehicle emissions, and it is unclear who across Government is in charge. The latest plan to address Nitrogen Dioxide levels is inadequate – leaving many UK cities with air pollution problems for years to come.

Policy Exchange is calling on the Government to:

- Provide clear leadership. The Government needs to develop a new strategy to clean up road transport and deliver the carbon targets set out in the Fifth Carbon Budget. At the same time, there needs to be closer integration between policies to reduce greenhouse gas emissions and policies to clean up air pollution.

- Put consumers first. The Government needs to ensure that consumers remain at the heart of the new strategy to clean up road transport. It would be morally unacceptable for the Government to heavily penalise diesel drivers who were actively encouraged to switch to diesel by previous Governments. We reiterate our call for a diesel scrappage scheme to take more polluting vehicles off the road.

- Let the market decide. The Government should scrap the European target for 10% renewable transport fuels by 2020 and avoid setting targets for the number of ultra-low emission vehicles on the road. The uptake of ultra-low emissions vehicles should be decided by market forces rather than government decree.

- Ensure value for money. The Government should signal a phase out of grants for Battery Electric Vehicles and Plug-In Hybrids by the early 2020s, by which time they are expected to be cost competitive with conventional vehicles.

- Develop a new system for rating vehicle emissions, that accurately takes into account both tailpipe emissions and indirect emissions (e.g. from power generation). The current system is becoming increasingly inaccurate and misleading.

- Tackle Infrastructure System Challenges: Cleaning up road transport could have significant implications for infrastructure – including transport, energy and even communications systems. Government must ensure that electric vehicle charging is smart and controllable to minimise the impacts on the power system.

- Consider whether road user charging might be more effective than fuel taxes. In the long term, Government should consider moving from the current system of taxing fossil fuels and carbon emissions to a system of road user charging (e.g. toll roads, charges per mile, or congestion charges in cities).