Dr Andrew Lilico

Chief Economist, 2009-2010

Dr Andrew Lilico is now the Director and Principal of Europe Economics. He is also a member of the IEA/Sunday Times Shadow Monetary Policy Committee. Prior to working at Policy Exchange he was Managing Director of Europe Economics, and has also worked as an economist for the Institute for Fiscal Studies and the Institute of Directors, as a business analyst for two plastics multinationals, as a mathematical chemist for ICI, and as an opera singer for Opera New Zealand.His first degree was from St John’s College, Oxford, and his doctorate was from University College London (where he has also lectured in Money and Banking, Macroeconomics, and Corporate Finance). He also has a Masters degree in Philosophy from the University of London.

On Fairness offers a concrete, simple and intuitive notion of what it means to be fair: that being fair is a special kind of being proportionate, with particular application in respect of equality, proportionality, and desert.

Bank Creditors, Moral Hazard and Systemic Risk Regulation argues that there should be a semi-automatic procedure to recapitalise troubled banks whereby bank bonds are converted into equity.

Industrial relations in the UK are in need of significant modernisation. Changes in the nature of employment and the workforce, increased concentration of union membership, the proliferation of litigation over the last decade and the shift in the balance of power to the trade unions has created a situation where the existing framework needs extensive revision,

By Ed Holmes. Edited by Hiba Sameen & Dr Andrew Lilico. The Coalition government plans to cut departmental budgets by 25% by 2014/15. This major report considers how to achieve this for six key departments: Education, Business, Innovation and Skills, Communities and Local Government, the Ministry of Justice, the Home Office and Energy and Climate Change. For these, we examine the status, feasibility and merit for spending reduction for each […]

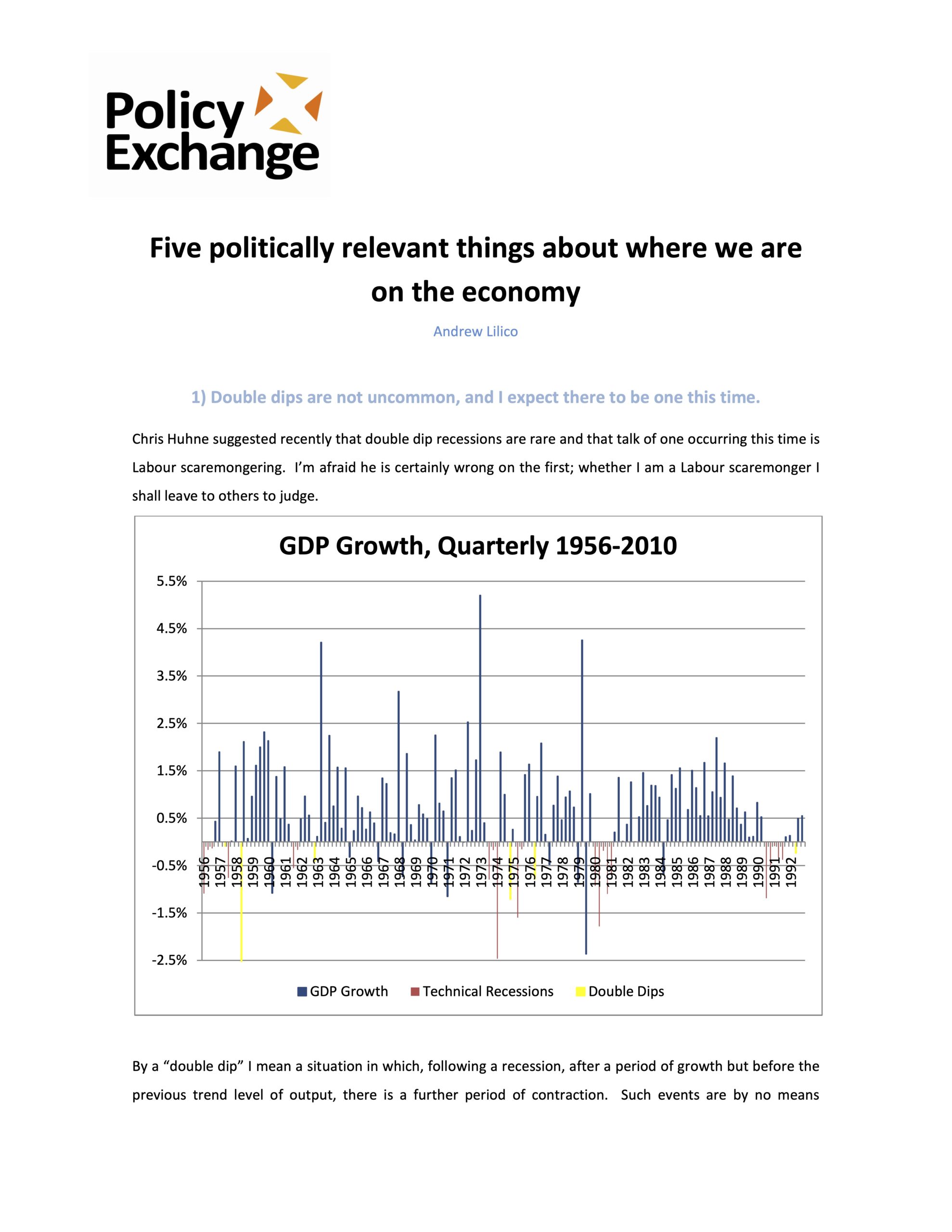

Chief Economist Andrew Lilico has predicted that a double-dip recession in the UK would be followed by a big boom, which in turn would send inflation as high as 10% with interest rates needing to be raised significantly in order to prevent runaway inflation.

Incentivising boring banking argues that deposit insurance in a fractional banking reserve system is economically damaging and financially destabilising (as it encourages excessive risk-taking by the banks), but politically impossible to avoid.

People used to say that public sector workers had great pensions to make up for their low salaries. That’s now out of date, as public sector workers have much better pay, as well as better pensions and conditions. People in the public sector are better paid and have pensions worth more - while enjoying shorter hours, more time off, and earlier retirement. There is scope to make savings without being unfair.

The report argues that, whilst it has not yet filtered into wider general consciousness, there is a large body of economic evidence suggesting that reducing government borrowing would lead to higher growth, even in the short term (i.e. cutting the deficit early would promote recovery, not endanger it).

This report examines the effect of various different types of tax on economic growth and employment.

Published soon after the announcement of the European Systemic Risk Board, Financial Instability: are Counter Cyclical Capital Controls the answer? looks at how Counter Cyclical Capital Controls (CCCCs) could work in the UK.

Controlling Spending and Government Deficits draws from twelve international and historical case studies in order to examine how Britain might best rid itself of the current overwhelming deficit.

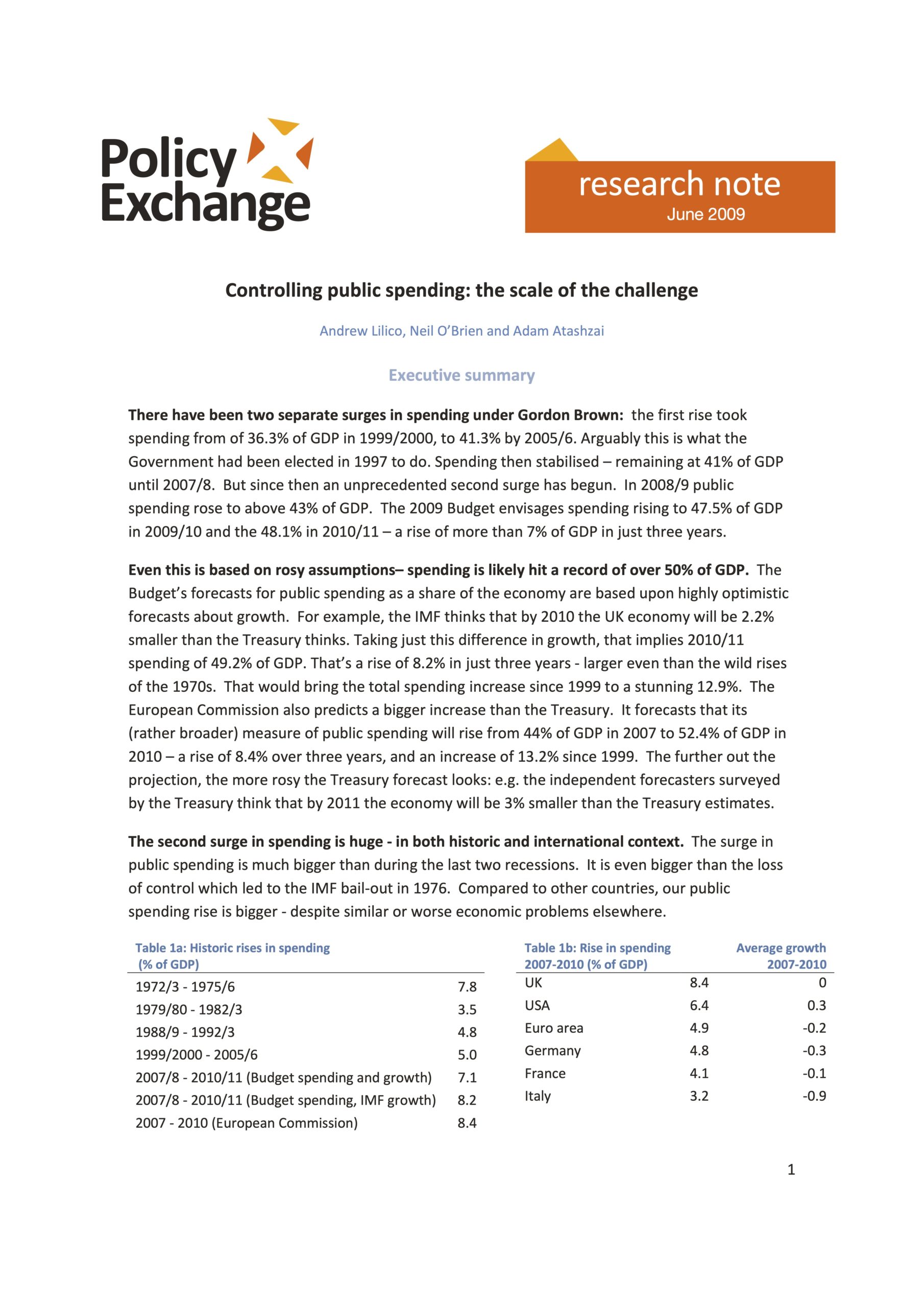

Government spending is growing far more quickly than in other countries, and faster than in previous recessions. This report finds that the surge in spending is not being driven by the recession.