Capping Welfare

Capping Welfare argues that post 2015, cutting Winter Fuel Payments or TV licences for pensioners is ‘simply tinkering around the edges’. Cuts to these pensioner perks would save at most £3 billion even if there were completely removed. In contrast, the State pension costs are set to rise by some £40 billion in today’s terms the next 50 years. This would mean younger generations saddled with enormous financial burdens.

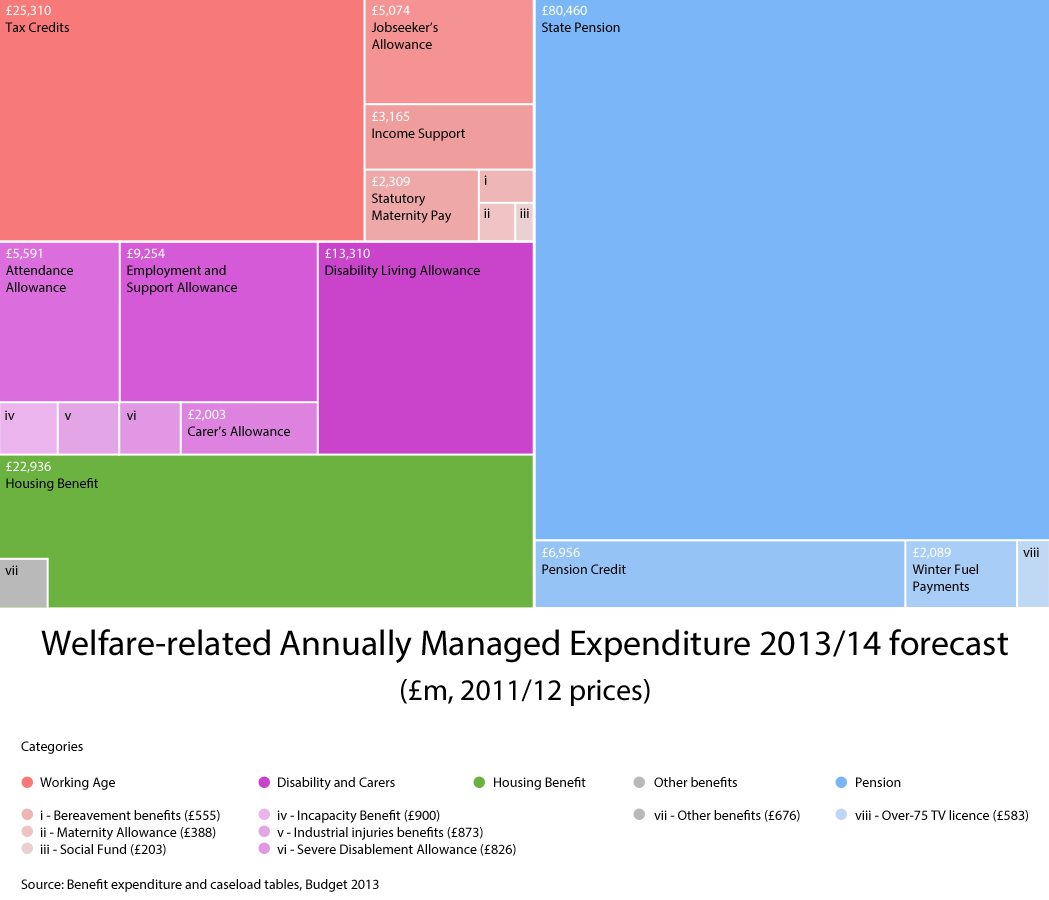

Annual Managed Expenditure makes up 50.8% of government expenditure – £379 billion for 2013/14. This is set to rise to 56% by 2017/18. The main components are benefits (working age and pensioner), tax credits and debt interest payments. This composition means that, in contrast to Departmental Expenditure Limits (DELs), it is the part of government expenditure that is harder to predict because it is determined by a range of factors outside any department’s direct control.

Increasing AME means that tax revenues are not available for spending on wider public services, meaning future rises would lead to cuts in areas such as health, education and defence.