Budgets are often seen as political ‘moments’ that can be used to recapture momentum and push the government’s domestic agenda. The Chancellor himself has said he understands that he needs to ‘tell a story’ on where the nation is going. As he puts the finishing touches to Wednesday’s ‘Red Book’, he should remember the moral of all good budgets – that without sound finance, you cannot have a strong economy with which to fund public services.

As the Chancellor prepares his Autumn Budget he is under pressure to ease the restraint on public spending, particularly on areas such as health and housing. After all, the budget deficit has fallen from a peak of 10% of GDP at the time of the great recession in 2008/9 to around 3% now. It might therefore be tempting to heed the siren voices calling for vast increases in borrowing – but the Chancellor should be careful before abandoning fiscal responsibility.

Budgets are often seen as political ‘moments’ that can be used to recapture momentum and push the government domestic agenda. The Chancellor himself has said he understands that he needs to ‘tell a story’ on where the nation is going. As he puts the finishing touches to Wednesday’s announcements, he should remember the moral of all good budgets – that without sound finance, you cannot have a strong economy with which to fund public services.

Japan has combined extreme levels of public debt with low interest rates

Some argue that the level of debt is not that important, quoting Japan as an example. Japan’s gross public sector debt is approaching 250% of GDP, almost three times as high as the UK. Such a high level of debt would normally be expected to require a rising interest rate in order to induce investors to hold additional issues of government debt. Yet as debt has risen, the yield on 10-year Japanese government debt has fallen to extremely low levels. (Indeed for a period in 2016 the yield actually turned negative following the Bank of Japan’s policy of negative interest rates.) So clearly there need not be a positive correlation between the size of public debt and interest rates on that debt. But because it hasn’t happened in Japan (yet), that does not mean the same situation will prevail in the UK if the debt to GDP ratio were to continue to increase.

But Japan is a special case with high, passive domestic savings

There are features of the Japanese situation that differentiate it from the UK. First, the vast majority of its huge stock of public sector debt is held domestically with only around 10% held by overseas investors. By contrast in the UK over a quarter (27%) of gilts are owned by foreigners. Being more reliant on international investors makes it more likely that yields on government debt rise as the level of debt rises. In Japan there has historically been a flow of funds whereby a corporate sector flush with cash increases its deposits with the banking system which in turn buys large quantities of Japanese government debt. Since the launch of its quantitative easing programme in 2013 the Bank of Japan has also been a big buyer of Japanese government debt – it now owns 40% of the stock. Even the domestic owners of UK gilts are rather less passive than their Japanese counterparts. Notwithstanding the pension obligation to match liabilities that underpins some demand for gilts, UK financial institutions are more focused on maximizing returns given risk rather than pursuing a positive domestic bias.

Debt interest can take up a big chunk of government spending

Despite a lack of interest rate effect in Japan, there are other areas where high levels of public sector debt may have damaging economic effects. First, even at low interest rates a large public sector debt will take up a significant chunk of government spending in the form of debt interest payments. In Japan one-quarter of total government spending is currently used to pay interest on government debt – even with yields sustained below 1%. The UK currently spends slightly less than 6% of its total expenditure on debt interest (£46bn out of a total of £802bn). But even this is more than the government spends on both transport and housing, for example. The message is clear – even at low interest rates high public sector debt eats up a large proportion of government spending and – since debt interest is not a discretionary item – other areas of spending are likely to be squeezed as a result.

Taxpayers will ultimately be called on to repay public sector debt

Of course not only interest but the debt itself ultimately has to be repaid. And it is domestic taxpayers who will foot the bill through increased taxation. In Japan the prospect of higher taxation in the future may be inducing households to save more and consume less today. Measured on an internationally comparable basis (gross rather than net) Japan’s household savings rate is relatively high at around 7%, especially so as Japan has a rapidly aging population. Negligible real wages growth may be the dominant explanation for anaemic consumer spending growth in Japan, but a relatively high savings rate exacerbates this weak performance. Certainly the UK savings rate is not at present being influenced by such considerations. But it is an additional factor to be borne in mind when the temptation to dismiss high levels of public sector debt as irrelevant surface.

The Chancellor should maintain downward pressure on the debt ratio

So as the Chancellor frames his Budget he should resist the temptation for a major relaxation in fiscal policy. The commitment to reduce government debt as a proportion of GDP should remain. Hence the budget deficit – also as a proportion of GDP – should continue to be reduced until it is rather less than the trend rate of GDP growth.

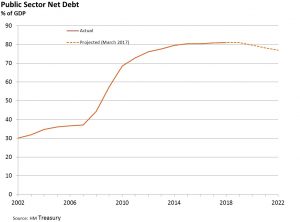

At the time of the last Budget in March net debt was projected to fall from 81% this year to 77% by 2021/22. This is mainly because the government budget deficit is forecast to fall further, from close to 3% of GDP this year to below 1% by 2021/22. Provided the economy is growing at a reasonable pace this will result in a decline in the ratio of debt to GDP. The Chancellor should continue to pursue policies that indeed reduce debt as a proportion of GDP. There is no pressing need to run a budget surplus in coming years. But the direction of travel should be a budget deficit low enough to so that the public sector debt to GDP ratio falls, eventually to around 60 per cent. This is an internationally-recognised sustainable level, albeit still well above that prevailing before the financial crisis (less than 40%).