An article of faith in the Momentum critique of contemporary market economies, which Jeremy Corbyn drew upon when he launched his election campaign, is that the system is rigged, and that the rich have got richer while the poor have got poorer. A central part of this analysis is the suggestion that, in advanced economies, the share of national income going to labour has fallen, and that the share of profits rewarding capital has risen. Over the last few years, many people have worried that there has been a ‘decoupling’ between average productivity and ordinary pay.

In recent years, the UK has, in many respects, bucked this international trend, however. Unlike in the US, median wages have grown strongly here, and households at the bottom of the income distribution have done better than households at the top. Between 1977 and 2007, real median household incomes doubled. This is partly because of a strong productivity performance in the 1980s and 1990s, but is also a function of a tax and benefit system that substantially modifies market incomes — lowering disposable income at the top of the earnings distribution, and raising it at the bottom. This partly reflects the effects of discretionary increases in tax on higher-income households. It is also owing, however, to the way in which, during a period of inflation when wages and salaries were squeezed in real terms, cash benefits were raised as a result of indexation. A flexible labour market, exhibiting a capacity for real wage adjustment in response to a succession of adverse shocks, has also contributed to incomes by maintaining labour-market participation rates, employment, and incomes. Overall, inflation has been relatively low in the UK since the early-nineties.

Even before the Great Recession, the UK labour market did relatively well in terms of middle-income households. Research from the Pew Center, which was highlighted in the FT this week, shows that from 1991 to 2010 the number of households scored as being ‘middle income’ rose from 60 per cent to 67 per cent. This contrasts falls in the same period of households scored as ‘middle income’ in the US, from 62 to 59 per cent; in Germany, from 78 to 74 per cent; and in Spain, from 69 to 64 per cent.

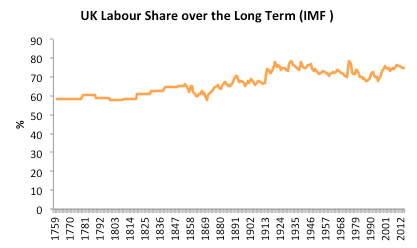

Much of the work of Thomas Piketty and the late Sir Tony Atkinson has emphasised the fall of the share of national income paid in wages over recent years. There is now general agreement that the global share of income fell by around 5 percentage points between the 1980s and 2006, at which point the trend was slightly reversed, rising by about 1.6 percentage points. Economists have found Piketty and Atkinson’s work arresting because it overturns a long standing proposition in the theory of economics that deals with distribution — namely, the stability of factor shares. The proposition was that, over the economic cycle, the ratios of national income taken by labour and capital were stable. As Robert Solow put it in 1958, in the American Economic Review, in an article entitled A sceptical note on the constancy of relative shares, there was a widespread belief that labour’s share was ‘one of the great constants of nature, like the velocity of light’. The new approach has overturned what Lord Kaldor termed one of the enduring stylised facts of economics, supported by a long tradition, that assumed a constant share of labour income in growth, macro-economic theory, and modelling. While the labour share is still relatively constant — having hovered at about 75 per cent in the UK for over a hundred years — there is no reason in principle, however, why structural shifts in the economy could not see it change.

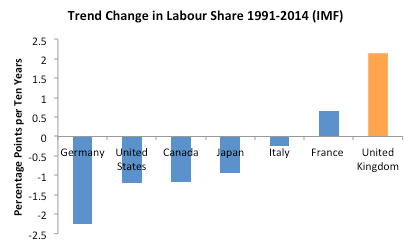

In its latest World Economic Outlook, the IMF paints an encouraging picture, where the world economy’s activity continues to pick up with growth of 3.5 per cent, increasing the size of the economy to $77.8 trillion using market exchange rates. However, the IMF also devotes a chapter to attempting to understand why labour incomes may be trending down, globally. Its analysis concentrates on the change in labour’s share of GDP between 1991 and 2014: the global share of labour fell by 2 percentage points over that period. The fall in labour’s share reflected declining shares both in advanced economies and in emerging market economies. In four of the world’s five largest economies, labour’s share fell, with the steepest decline occurring in China.

The exception was the UK; the IMF found that ‘labour’s share of income in the United Kingdom has trended up’. This is further evidence of how well the UK labour market has been doing in recent years. This is not necessarily unqualified good news, however. One reason the labour share might have gone up is businesses substituting labour for capital, which, in the long term, could lower productivity and standards of living. Nevertheless, in the short term, it is still better to keep as many people in work as possible. When you combine this data with the wider picture of flat inequality and historically high employment rates, it is very hard to paint the UK economy as one that helps only the rich and hurts the poor.

Changes in shares of national income between wages and profits have to be treated with caution. The IMF point out that changes in the composition of employment — such as a shift to self-employment — can result in labour income being scored misleadingly as part of profits. Inadequate scoring of the depreciation of capital, in a period when technical innovation shortens the life of capital assets, can lead to profits being over stated. Much of the shift in the capital share in the US, for instance, may be down to restrictive planning laws, which increase the cost of housing.

The IMF offers an interesting account of the different factors that may have influenced the change in reported factor shares, from technological automation to the integration of global supply chains. Looking forward, it is possible that further automation will lead to the fall in the labour share coming to the UK, too. That said, as the IMF notes, such ‘technological anxiety’ has existed since at least the first industrial revolution took place, between 1760 and 1820. The lesson of the last few decades is that, with the right policies in place, such changes can be to the benefit of everyone.