Policies proposed in the parties’ manifestos, and arising from the overall election debate, have directed attention towards the issue of wealth. Questions explored include those focused on how much wealth people with assets should be obliged to use to pay for the social care they might need, and the extent to which the state should protect those people and their wealth — particularly when it is tied up in their homes — by containing the bills individual households might pay in such situations.

These old ‘size of the state’ questions are, essentially, moral ones, relating to how things should be in a fair society. We expect the state to protect us from those dangers against which we cannot protect ourselves; social insurance plays a necessary part of the welfare provision of any modern developed economy. The various ways in which we attempt to answer such questions, however, is also heavily influenced by the realities of the society in which we live, and its general economic concerns. At the heart of those concerns, currently, stem issues relating to the growing agedness of UK society, and questions about housing.

The current debate has exposed a policy argument that has gained popularity over the past decade, which suggests that the taxation of wealth could be a new source of revenue to meet demand for public services, amidst reluctance for discretionary increases in income and expenditure taxes to pay for them. That argument has informed radical critiques of the economy following the Great Recession, including those set forth by Momentum. It has also become conflated with concerns about the increase in house prices, with some economists contending that such capital gains should be taxed.

As the debate continues, and in order to assess the policies proposed, it is helpful to clarify what we know about wealth in the UK. There is less data available about the distribution of wealth than there is on income, not least because there is no explicit annual wealth tax. The ONS carries out a biennial Wealth and Assets Survey (WAS) series, however. In December 2015, it reported that, between July 2012 and June 2014, the total combined wealth of all UK households was £11.1 trillion — an increase on the previous two years of 18 per cent.

To calculate a household’s total wealth — a ‘stock’ concept, which the ONS refers to as ‘the balance at a point in time’ — the survey uses respondents’ data, and IFS modelling, to collate figures relating to net property wealth (gross, minus mortgage debt), net financial wealth, physical wealth (the contents of the household’s main residence and other properties, collectibles and valuables, and vehicles) and private-pension wealth. (It is important to be aware of this dependence on net figures: when we casually consider the size of someone’s wealth, we do not typically account for their mortgage debt.) According to WAS, the median household’s total wealth now stands at £225,110.

In that assessments of wealth represent households’ ongoing financial situations in terms of the assets they have accrued over time, average wealth tends to be less equally dispersed than income. Britain’s relatively low household-savings rates make this disparity even greater. In Policy Exchange’s No Worker Left Behind report, Jonathan Dupont emphasises how British savings rates lag behind France and Germany, ‘let alone the levels saved by much poorer Chinese households’.

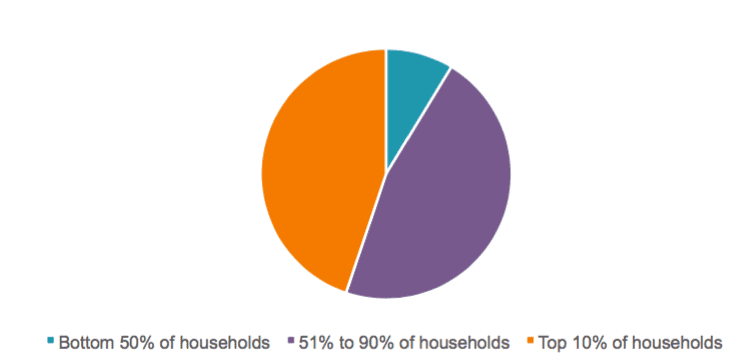

The uneven distribution of wealth is neatly exemplified by the 2015 WAS report’s calculation that the ratio between the top and bottom deciles is currently ten times larger than it is for income. The top decile (which includes extreme outliers) owns 45 per cent of the total wealth, whereas the bottom owns less than 0.5 per cent.

Distribution of UK total household wealth by percentile, 2012-14 (ONS)

In his 2015 book, Inequality: What can be done?, the late Tony Atkinson uses research by Jesper Roine and Daniel Waldenstrom to provide a bigger-picture view, showing that the wealth owned by the UK’s top 1 per cent fell by 17 percentage points between 1950 and 1975, before increasing by 2 percentage points between the early 1980s and 2000s. Atkinson comments that, while ‘we need to be cautious in drawing conclusions about any upturn in wealth concentration’, we can ‘conclude that the trend to less wealth concentration came to an end’.

The latest WAS survey shows that the disparity in wealth between the top and bottom deciles is growing: the bulletin emphasises that ‘the increase seen in the top 10 per cent of households accounted for over half of the 18 per cent increase’. This is unsurprising when we consider the rising cost of housing, and also the breakdown of households’ wealth, with particular reference to the private-pension situation:

Household total wealth by component, Great Britain, 2012 –2014 (ONS)

We also must recognise regional disparities: the report points out that 22 per cent of South-Eastern households are within the top decile of the distribution, in comparison with only 2 per cent of those in the North East. Regarding the intergenerational spread of wealth in the UK, WAS reports that, ‘like other forms of wealth, financial assets appear to be accumulated as people get older’. Indeed, its findings show that 23 per cent of those aged 65 or older live in households with net financial wealth of over £100,000, as opposed to only 9 per cent of 16- to 24-year-olds, and 8 per cent of 35- to 44-year-olds.

HM Revenue and Customs also produces a statistical series on identified personal wealth — the Distribution of Personal Wealth Statistics — based on inheritance-tax returns, although its data represents only those estates requiring a grant of representation, meaning it is ‘not intended to be an estimate of the total value of personal wealth held by the whole UK population’. The series was last updated in September 2016 to report that ‘the distribution of wealth held by each decile has been broadly unchanged since 2001-03’, and that — as with WAS — the top decile of its distribution holds around 45 per cent of the total wealth.

Further analysis about the distribution of UK wealth, and its significance — not least in relation to income and consumption — can be found in Policy Exchange’s recent report, Clarifying Income Distribution: A issue of equality or need?.