Last week the IMF downgraded its 2017 GDP forecast for the UK from 2% to 1.7% at the same time as upgrading its euro area forecast to 1.9% from 1.7% previously. Upgrades to forecasts for Germany, France, Spain and even Italy contributed to the revision. A forecast of faster growth in the euro area than in the UK for this year is bound to feature in the arguments about Brexit: the UK struggles with post-Brexit uncertainty and squeezed incomes at the same time as the euro area enjoys a strong domestic recovery with low inflation. The inference being that the UK is beginning to pay the economic price for its decision to leave the EU.

UK and euro area at different stages of economic cycle

The main reason for the divergence of these forecast revisions is rather different economic growth in the first half of this year. In the UK, after a disappointing 0.2% GDP growth rate in the first quarter, the preliminary estimate of the second quarter last week edged up slightly to 0.3%. By contrast euro area GDP increased by 0.6% in the first quarter. The second quarter estimate is due on 1 August. But data already out showing buoyant growth in France (0.5%) and Spain (0.9%) suggest that the pace of growth will have been at least maintained through the second three months of the year.

The UK hits a soft patch…..

The UK economy has undoubtedly hit a soft patch. Consumers are facing a squeeze on their incomes as inflation spikes higher while pay settlements stagnate at low levels. As a result household spending – often the main driver of growth – will probably slow this year. But the jump in inflation is primarily due to the fall in sterling last year pushing up import prices. This effect will dissipate over time and inflation will fall back. There is also a boost to the economy from that drop in sterling which has made UK exports more competitive at a time when global economic growth is picking up. The good news for the UK is that the economy is structurally in pretty good shape, notwithstanding some concerns about rising household sector debt. True, the UK may face uncertainty about its post-Brexit trading arrangements. But of course forecasts of an immediate slump after last June’s referendum proved well wide of the mark. The economy grew strongly through the second half of last year, prompting GDP forecast upgrades by most forecasters, including the IMF.

…..as the euro area enjoys an upswing

Meanwhile the euro area is enjoying a cyclical recovery, assisted by €60bn a month of asset purchases by the European Central Bank (ECB). The recovery is firming and becoming broad based as labour markets improve and credit growth accelerates. Private consumption is at last boosting growth. Because of previous weakness in the euro area economy there is little upward pressure on inflation. Expansion is likely to continue through into 2018 (the IMF forecast is for 1.7% GDP growth next year).

Structural flaws, economic divergence persist in euro area

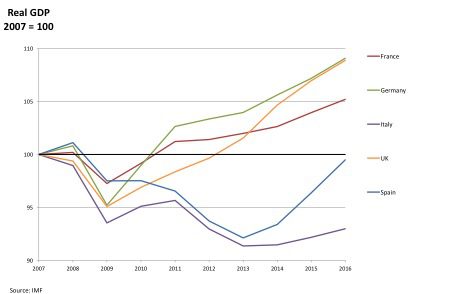

But the single currency has serious structural problems that, unless resolved, will eventually hamper growth and/or trigger another financial crisis. The IMF acknowledges this in its latest Article IV report on the Euro Area also published last week, and urges various reforms. These include supply side measures to boost low levels of productivity growth – and GDP growth – in some countries. The chart below illustrates growth divergence among major euro area economies over the last 10 years – and includes the UK as a comparator. Germany and France have recovered the output lost during the Great Recession and have subsequently maintained reasonably steady growth. The UK and Germany are the best performers followed by France. But Italy and Spain have languished, especially Italy which has barely grown at all since the launch of the euro in 1999. The Spanish economy has recently revived and the strong reading for the second quarter means that at last output has regained the level prevailing before the financial crisis of almost 10 years ago.

There is also a need for reform in the banking sector. Despite recent improvements as capital buffers have increased areas of fragility remain, notably in the Italian and Spanish banking sectors. The extreme divergence in Target 2 balances – the euro area’s inter-bank payments system – is illustrative (discussed in an earlier blog). Huge credit balances for Germany and large deficits for Spain and Italy pose risks to the banking system. The IMF recommends a banking union as a solution to this with common deposit insurance and fiscal funds for support. This would be the first step on the way to the inevitable fiscal union that ultimately will be necessary to hold the euro together. The current high levels of public sector debt in many countries are another potential source of crisis and weak growth.

Brexit a downside risk for the euro area too

Finally the IMF point out that uncertainty about Brexit is a downside risk not just for the UK but for the euro area as well. The IMF note that “uncertainty related to Brexit negotiations could dampen investment and consumption in some countries”. But it is undoubtedly good news that the euro area is enjoying an economic upswing – good news too for the UK since 44% of exports go to the EU. The UK is facing a major challenge in Brexit – but so is the rest of the EU and the euro area. Structurally the UK is in better shape than the euro area to deal with the bumps in the road ahead.