Policy Exchange was pleased to welcome Sir Paul Tucker to launch his book Unelected Power: The quest for legitimacy in central banking and the regulatory state. The book explores two issues that Policy Exchange takes a serious interest in: monetary policy and financial market regulation, and the tendency for policy decisions to be taken by technocratic elites that are removed from direct political guidance and oversight. These are the issues that are at the heart of our Judicial Power Project. They are also reflected in a wider range of institutional questions touching on matters ranging from utility regulation to competition policy.

The right institutional setting for making decisions

There is plainly a continuum where different decisions should be appropriately made. In tax law for example it is clear that the structure of taxes – income versus expenditure taxes and their rate and tax base – as core policy questions should be made by politicians operating in the executive and legislative branches of government. The assessment of the tax bill that an individual or corporation should have to pay should be made by an executive agency wholly separate from ministerial direction in relation to revenue collection. You do not want the Chancellor or the Financial Secretary of the day applying tax law in an arbitrary manner. Arguments turning on the reasonability of bill in terms of present tax law and the compliance of the taxpayer should be resolved in either the criminal or civil courts or in the system of specialist tax tribunals, where appropriate burdens of proof and rules of evidence can be deployed in a forensic setting.

The increasing use of expert agencies in modern complex societies

In a complex modern society many more potentially contentious and – for those involved, expensive – matters are delegated to administrative agencies independent of political influence. As well as matters such as competition policy and utility regulation, there is a growing range of areas from environmental regulation to health, fertility and digital regulation that politicians find it easier to manage by handing over responsibility to expert technocratic agencies.

In practice politicians willingly step away and leave to the technocrats

Paul Tucker made the interesting observation that politicians were ready to resile from important areas of policy and often reluctant to take an interest in their continuing responsibility to set the broad objectives for these technocratic bodies. Drawing on his own experience as a Bank of England official and former Deputy Governor of the Bank, he made it plain that he welcomed political scrutiny and was in many ways disappointed by the lack of sustained interest in the conduct of monetary policy after the central bank was made operationally independent in 1997.

There are fewer Members of Parliament who take an interest in monetary economics and finance than there were twenty or thirty years ago. Moreover, any MP who gently inquires about, for example, the criteria the Treasury uses to assess the Inflation Target before it is reconfirmed in a Budget Statement, is likely to be fobbed off with a reply and made to feel that that sort of interest is unhelpful. Sebastian Mallaby, the biographer of Alan Greenspan, made the point that while many technocrats were insulated from political pressures as they applied their expertise, they were often first class politicians and political manipulators in their own right. Alan Greenspan was the absolute exemplar of this, selectively briefing the media, discretely lobbying Congress over proposed legislation that did not suit him and often conveying the public impression of one thing while thinking the opposite.

There are several big questions that need to be debated about the tasks of modern central banks and the way they go about carrying them out. In many respects they are political and probably will have to debate in a wider context than the annual Jackson Hole Summit – the away day for central bankers and economists who work on monetary policy. The first big question is whether an inflation targeting regime is sufficient to stabilise the macro economy in the sense of delivering price stability and consistent economic output and jobs, in effect smoothing out the ups and downs of the economic cycle. It may well be that the monetary conditions needed for stable prices and a benign economic cycle are much more complicated than interest rates directed at low inflation. Asset prices are not incorporated into price indices. In practice this means that inflation can remain low for an extended period of time while huge asset price bubbles accumulate. The inevitable bursting of these can have devastating effects on the stability of the financial system and generate adverse wealth effects that undermine household consumption and business investment.

The second big question is what the governments and central banks will do in the next financial crisis, when it turns out that all the fancy foot work of strengthened Basle capital adequacy is not enough, the living wills do not work and there are high degrees of contagion with plenty of institutions that meet the criterion of too big to fail or too interconnected to fail. Over the last forty years we have had a succession of financial crises – Third World debt, savings and loan, Mexico, Russian and Asian and long-Term Credit Management. And then came the Global Financial Crisis of 2008.

By the 1990s the potential contagion in international financial markets was much greater than in the 1960s, 1970s and 1980s. Not least because many countries including the UK had capital controls and capital accounts were not fully integrated. By the late 1980s new trading devices and technology had started to amplify the speed and extent of price adjustment in the event of a financial shock. The move to a market accounting world more readily exposed the fact that an institution having a difficult time may not just be short of cash – illiquid – but, on a proper reading of the accounts, insolvent. In the next crisis there will be a new dimension that policy makers will have to be alert to. This is the folk memory of the people who at one point had thought they had lost everything in Iceland as its banking system imploded. These include local authority Directors of Education, university finance officers as well as retail depositors. Public confidence in the banking system and financial markets will be much more brittle in a future crisis.

In his book Paul Tucker mentions the concerns of the Bank for International Settlements about the way that central banks have dealt with temporary problems by increasing liquidity and cutting to the quick storing up problems for the future. In effect central banks have stabilised the business cycle by creating and amplified financial cycle.

An amplified financial cycle

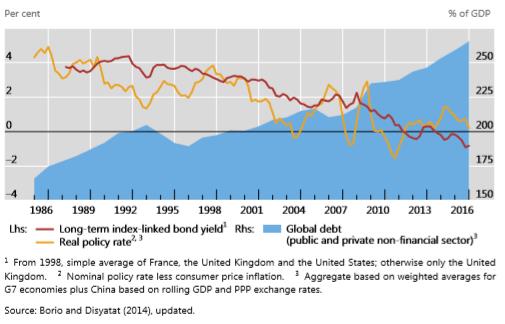

Real interest rates have been lowered over the last thirty years and this fall in borrowing costs has been matched by an increase in the stock of debt world wide. In short creating the conditions for complex asset price bubbles and financial instability.

Lower real interest rates and rising public and private debt

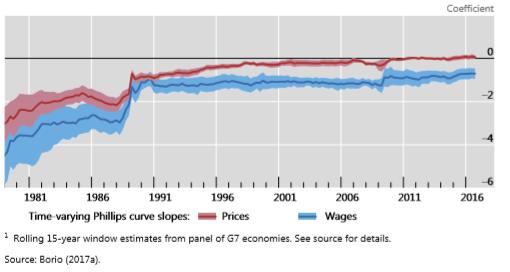

The expansion of liquidity has not resulted so far in a less stable price level. If anything the opposite has happened. Wages and prices appear to have become firmly anchored. The response of both price and wage inflation to domestic measures of spare capacity is muted and has declined over time.

Phillips Curve –a flatter curve for prices and wages

This may partly reflect the success of central banks in establishing their credibility, although the BIS suggests it may more likely reflect structural changes to the real economy such as globalisation and the entry of the former socialist command economies, not least China into the international economy increasing supply and exerting downward pressure on prices. It may also reflect the changed role of the trade unions in wage bargaining and changes in the structure of the employment market.

These are all important policy questions that Policy Exchange will be exploring. Our ambition is to encourage as much debate about them as possible among policy makers and interested non-specialist commentators in order to stimulate a climate of informed scrutiny of expert opinion.