Nationalisation: Good Bye Lenin and a misplaced ‘nostalgia chic’ — be careful what you wish for

A striking feature of the 2017 UK election campaign is the Labour Party’s substantial agenda of nationalisation, which extends from rail to energy and water. It is the most vivid expression of the ideological partisanship that Jeremy Corbyn’s leadership has revived. Many people today have forgotten — or were not alive during — the time in which Britain’s leading utilities were all government opened and run. It is worth reminding ourselves of Britain’s experience with nationalisation, and the interesting challenges it has presented. Issues relating to regulating, managing, and properly investing in complex monopolistic utilities are not resolved merely by covering them in the wrapper of nationalisation. Equally, the privatisation of industries does not, by itself, eliminate political risks.

Moral hazard, the challenge of principal and agent, rent seeking, the absence of bankruptcy, and the threat of takeover — along with a soft budget constraint — represent a powerful cocktail. Both the original rationale, and the subsequent measures of denationalisation are now obscured not only from the memories of the wider public but also from those of many contemporary politicians. The old central argument for public ownership was about the greater efficiency of planning, and the opportunity to harness economies of scale and end the waste of competition.

Nationalisation — the efficiency rationale

The Fabian socialist paradigm was the Post Office, perceived as a model of efficiency. The idea was that whole industries could be combined, and then run by the government with equal success. In the 1920s, this efficiency argument was overlaid by a different concern: some industries were unprofitable, and the only way of avoiding the social consequences of their decline was nationalisation. The 1919 Sankey Commission made the first official suggestion that the coal mines should be nationalised, in response to the structural problems that were making the industry uneconomic after the First World War. The experiences of the two world wars added to politicians’ confidence in their ability to run and manage Britain’s utilities.

Swift disappointment — who would nationalise Marks and Sparks to make it like the Co-op?

The UK’s experience with nationalisation has been distinct. In 1945, the Attlee Labour government embarked on an agenda of taking control of the commanding heights of the economy. Utilities such as gas and electricity were taken into public ownership, along with the coal mines and the railways. From the start, the nationalised industries were managed as public corporations. The Lord President of the Council, Herbert Morrison, established the model, as minister for economic planning. Public corporations were to be operated just like private corporations, run by their boards rather than the minister or government department sponsoring them. Previous Fabian and trade union concepts of workers’ control were abandoned; collective bargaining between union and employer was the basis for the management of the workforce. Disappointment with the performance of the nationalised industries set in early, however. Anthony Crosland captured this dissatisfaction with his memorable quip that few people would want to nationalise Marks and Spencer in order to ‘bring it up to the level’ of the Co-op.

Marginal cost pricing and the commanding heights of the economy — a recipe for financial losses

Most of the principal nationalised industries were complete state monopolies with no direct competition. They were publicly owned and controlled, so that, in principle, the public interest was secured through ministerial oversight. They were expected to break even, and make a return on capital, but it was not clear what level of profit would be appropriate, given that they were state monopolies. For some twenty years, there was a recondite debate among economists about the appropriate pricing structure for these industries. Drawing on an economic literature that can be traced back to the French engineer Jules Dupuit’s paper, The measurement of the utility of public works, it was generally concluded that prices should be marginal costs. The 1967 White Paper, Nationalised Industries: A Review of Economic and Financial Objectives (Cmnd 3437), set out what was supposed to happen: the marginal cost principle was laid down, buttressed with an additional rule determining that accounting costs were to be covered in full; consumers were to pay the true costs of goods and services; and there were to be specified rates of return for specific industries. It was explicitly recognised in the paper that public corporations undertake commercial operations and non-commercial social activities, and that ministers using taxpayers’ money should take responsibility for such activities. There was always an awkward practical matter at the heart of this sophisticated exploration of Paretian optimality, however. Average costs in most of the nationalised industries had a tendency to decline continuously over the relevant range of outputs, with the result that marginal cost was less than average cost. That such cases are likely to result in a deficit meant that there was a conflict been financial rectitude and optimal resources allocation.

From the start, the nationalised industries had a record of making losses, not least because they were contracting unviable businesses — as exemplified by coal. Despite the Morrisonian model, boards were not left to manage their businesses freely. Ministerial guidance distorted the location of industry and the pace of adjustment to change when any contraction was necessary. From the earliest days, it was never clear who was in charge.

The awkward combination of underinvestment and duff projects

Given that borrowing by public corporations forms part of counterparts of the public sector borrowing requirement, investment in the corporations was constrained by the challenges of the wider public finances. Nationalised industries had little incentive to improve efficiency. Decisions on capital investment were often coloured by managers showing the kind of dogmatic enthusiasms that do not take account of the commercial viability of projects, and who were able to avoid the sort of scrutiny of costs that access to private capital markets would involve. In terms of managerial enthusiasms, British Rail’s experiments offer a vivid example, and engineers at the Central Electricity Generating Board wasted years — and huge amounts of public money — trying to perfect a gas-cooled nuclear power station. As evidence mounted to show that such a project offered an inferior technology, the engineers continued to pursue it out of a sort of cussed technological nationalism. Meanwhile, the nationalised electricity industry, led by the late Lord Marshall of Goring, hid the full costs of de-commissioning nuclear power stations — costs that were only full exposed during the process of privatisation in 1989.

Nationalisation amplified complex issues relating to the following problems: how to run a natural monopoly; how to ensure that consumers pay the full cost for services, yet are not exploited by those services’ provider; and how to control damaging externalities, when the owner of a business is both its regulator and financier. In the 1970s, Conservative ministers subjected nationalised industries to more stringent price control than the private sector, resulting in huge financial losses. After 1974, this was reversed to deal with their external borrowing requirement. The price of a first class stamp rose 240 per cent, and British Rail fares went up by 87 per cent in the two years to April 1976. The latter price rise had little effect on British Rail’s losses, however, which continued running at £500 million in 1976.

The water industry offers a good example of the way in which much-needed spending was systematically neglected, including that which would have prevented pollution by cleaning rivers, and managing sewage. The water industry was not properly regulated from an environmental perspective until it was privatised; it is worth remembering that it was the old nationalised industry that poisoned the people of Camelford with twenty tonnes of aluminium sulphate.

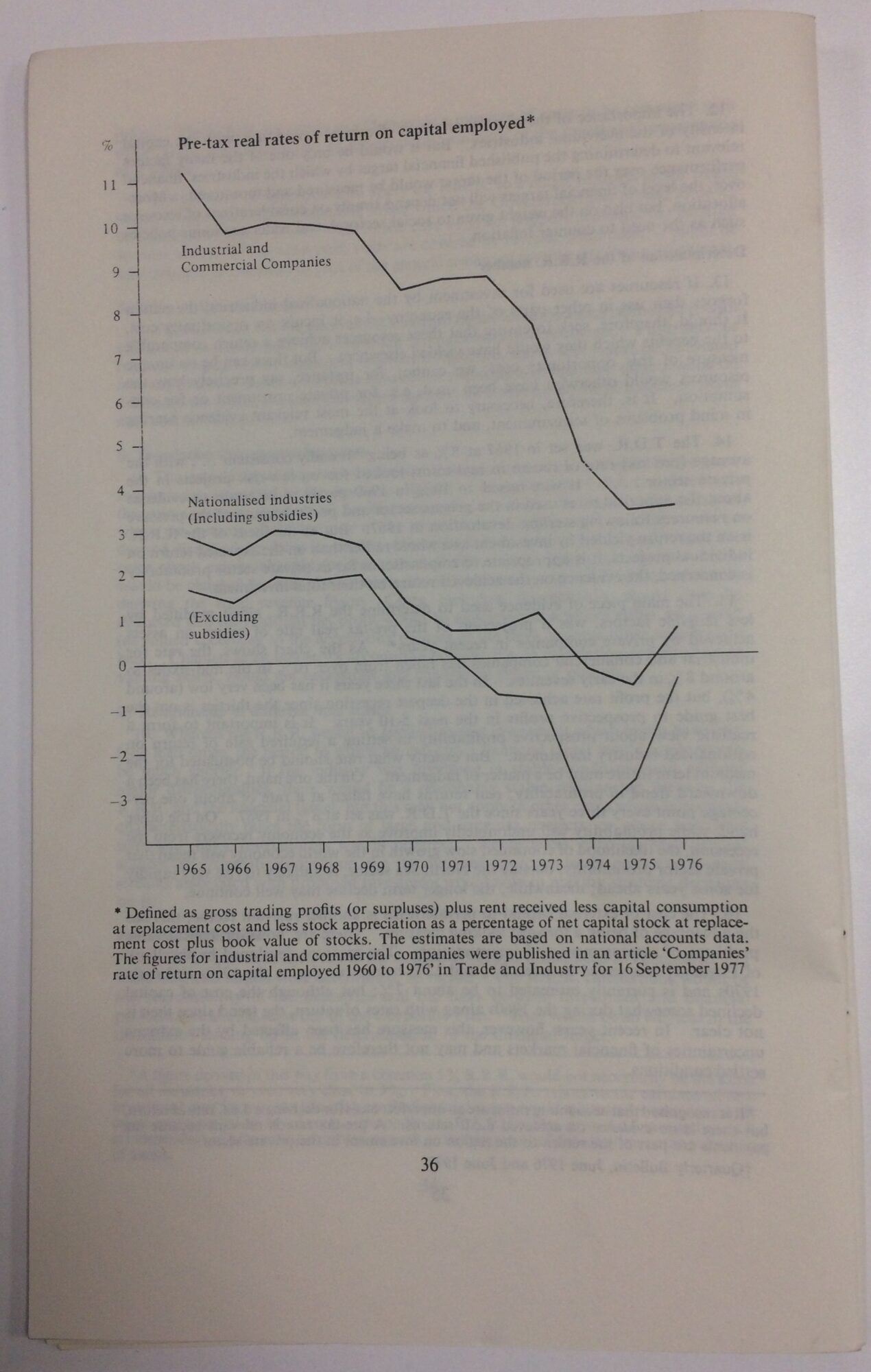

A chronically poor and falling rate of return on capital

In the 1970s, the House of Commons Nationalised Industries select committee concluded that the government had failed to meet its objective of ‘exercising its control publicly and according to well-defined ground rules, without interfering with the management functions of the industries themselves’. The 1978 Nationalised Industries White Paper was published in response. It reads like a catalogue of error: the industries were distinguished by a poor rate of return on capital, weak productivity, and chronic financial losses.

The record after privatisation

After privatisation, the thirty-three state-run businesses that had, in 1980, cost the taxpayer over £500 billion a year in losses began, by the mid-90s, to pay over £2.5 billion in taxes to the exchequer. They saw huge improvements in productivity, and businesses and consumers benefitted from lower prices. Domestic gas prices fell by around a quarter, and the price of gas to industrial users fell by almost a half. Electricity prices fell by around 2 to 2.5 per cent a year, and the price of telecoms fell 40 per cent. Water prices rose as the industry, which was properly regulated for first time, replaced its Victorian infrastructure and cleaned Britain’s polluted rivers and beaches.

The process of privatisation has had its flaws. Yet most evidence suggests that it has significantly improved efficiency in utilities and transport. Policy objectives have been clarified, and effective regulation has been introduced, which has helped to bring down costs and enable some of the radical structural changes we have seen in industries like telecoms or aviation. People currently cultivating the kind of nostalgia chic that welcomes a return to nationalisation should be careful what they wish for.