This week the IMF publishes its Spring World Economic Outlook that will forecast growth of 3.9 per cent. The world economy is now expanding in a coincidental manner with mature expansions underway in the US and the UK and the eurozone now exhibiting a steady cyclical recovery. Central banks and finance ministries now face difficult macro-economic policy decisions. After what is now a protracted but much slower paced period of expansion in the US and UK, how do they withdraw monetary and fiscal stimulus and prepare for the future and avoid or mitigate potential future risks?

The need to deal with policy challenges when the macro-economic environment is benign

They need to do this for two reasons. The first is to avoid either an unacceptable increase in inflation or an asset price bubble undermining financial stability by encouraging investors to take progressively greater risks with their balance sheets. The second reason is to give themselves future policy scope to deal with crises. There is a growing recognition that policy makers must take decisions now, in order to give themselves future capacity to stimulate the economy in the event of a recession. A good example of this line of thinking is Christine Lagarde’s speech in Hong Kong that reminded finance ministers that it is at this stage of the economic cycle that it is time to repair public sector balance sheets -so that in the event of a future crisis governments have scope to respond.

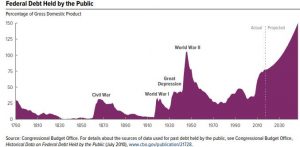

The President of the Federal Reserve Bank of Boston, Eric Rosengren, also explored a similar theme last week in relation to US monetary policy and the federal government’s accumulating debt. His concern is that ‘by using up so much fiscal capacity now – by which I mean the ability to lower tax rates or boost federal spending to offset economic weakness – the country risks not having sufficient fiscal capacity in the future when it might be needed. And this lack of fiscal capacity would be particularly troubling if monetary policy could not aggressively offset adverse shocks’. He said in a recent speech that ‘in some sense you are using up some of your dry power now’. Rosengren is therefore ‘in favour of somewhat more tightening than the median member’ arguing that ‘on average we could lower rates by less than three percentage points in response to a recession. Since in many recessions we lower rates by as much as five percentage points, it is quite likely that interest rates would reach zero again in a downturn’.

Issues that will cause central banks to prevaricate

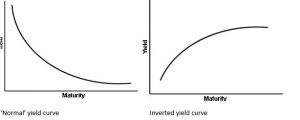

The reason why this presents central banks with a challenge is that inflation remains low and there are also signs of weakness in credit and the demand for money. This makes it harder for central banks to put up interest rates. In addition the shape of the yield curve is changing in a manner that many financial market practitioners have associated with a warning of much slower economic activity and potentially even a recession.

The reason why this presents central banks with a challenge is that inflation remains low and there are also signs of weakness in credit and the demand for money. This makes it harder for central banks to put up interest rates. In addition the shape of the yield curve is changing in a manner that many financial market practitioners have associated with a warning of much slower economic activity and potentially even a recession.

The economic consequences of an inverted yield curve

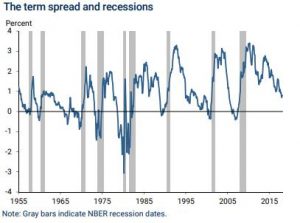

Over the last few months short rates have continued to rise while interest rates on longer maturity lending (bond yields) have not moved to the same degree. This has twisted the shape of the yield curve and made it flatter. The rule of thumb that many market analysts employ is that an inverted yield curve where short rates are higher than long rates is an indicator of a recession within about two years. Since 1955 this has signalled all nine US recessions with only one occasion in the mid-1960s when there was a slowdown rather than a recession.

The question that central banks face – apart from the low levels of inflation – is whether increases in the short-term policy rates, in current circumstances may moderate economic activity less than they would normally do given the unusual policy environment that has existed since the Great Recession. There is also a further question that arises from the extent that the level of the so called ‘natural policy’ rate of interest may have changed. A lower level of interest rates may imply that low long-term rates do not necessarily reflect a pessimistic economic outlook but rather imply a new normal for interest rates.

Is the shape of the yield curve a reliable predictive indicator given the change in the natural rate of interest?

This appears to be the judgement of the new President of the Federal Reserve Bank of New York. John Williams will shortly be leaving his post as President of the Federal Reserve Bank of San Francisco and will become not just head of the New York Fed but Vice Chairman of the FOMC and, unlike other regional federal reserve bank presidents, a permanent member of this interest rate setting committee. He is a monetary economist who has given great thought to these questions. He wrote a note last October where he explored all these things. His analytical starting point is the level of r-star, the natural rate of interest. This is the rate expected to prevail when the economy is operating at full capacity. While a central bank can determine short-term interest rates, r-star is a result of structural economic factors that are beyond the influence of monetary policy.

Fundamental non-monetary drivers of the natural rate of interest

These factors include the rate of sustainable economic growth, weaker productivity growth, demography and the consequences of an older population, slower growth in the labour force and lower fertility. These influences combine to lower the natural level of interest rates and beyond the influence of a central banks.

What is today’s r-rate or natural rate of interest?

Taylor’s rough calculus is that r-star is currently around 0. 5 percent in the US. Assuming the Fed achieves its goal of a rate of inflation of 2 per cent the typical, or normal short-term interest rate would be 2.5 per cent. This is two percentage points below what the normal interest rate looked like 20 years ago. This is not far below the Fed’s current projections of the federal funds rate once it completes is planned programme of tightening of 3.5 per cent by 2020. The spread between long-term and short-term yields exerts an important influence on bank profitability, and it narrowed during the period of very low interest rates following the crisis. An important question is the extent that it will return to the previous or old normal level it had before rates changed or if it will turn out that there is a ‘new normal’ for this spread as well.

The factors that will influence this will be the consequences of the Fed unwinding its extended balance sheet and the extent to which the downward trend in interest rates may have artificially widened the spread between short term interest rates and long term bond yields. Taylor has speculated that the future normal spread between a 10-year Treasury note and the federal funds rate may be something close to 1 percentage point.

In any event the new President of the New York Fed takes the view that policy has to be tightened and having given a lot of thought to the matter thinks that complex technical arguments about the structure of the yield curve and previous economic relationships that may have flowed from it, should not impede returning interest rates to a more normal level. This is probably just as well given the Congressional Budget Office’s Budget and Economic Outlook 2018 to 2028. This projects deficits that will result in a stock of government debt at over 100 per cent of GDP, a ratio generally considered to be financially destabilising. This suggests the Fed needs to build up all the policy discretion that it can and that other central banks in advanced economies, such as the UK, should probably follow suit.