The British economy has for almost 40 years, since the abolition of foreign exchange controls in 1979, been an unusually open international economy. British domestic investors have been allowed to invest overseas and foreign investment has been welcomed – allowed into British capital markets and welcomed into property and product markets.

Furthermore Britain has created one of the most flexible labour markets in the OECD, has a currency that can adjust to changing circumstances and an independent monetary policy that can be directed at its domestic circumstances.

A mature economy that after years of problems again performs like a normal advanced economy

In the period between 1945 and 1980 the UK experienced a relative economic decline and exhibited three big macro-economic problems that were partly related. These were: relatively high and unstable inflation, a labour market problem and a balance of payments problem. By the 1990s the inflation and the labour market problem were broadly resolved. The balance of payments problem was removed by the effects of North Sea oil production.

Britain’s Balance of Payments Problem Returns?

There were hints of a remaining awkward balance of payment s challenge. For example, at the peak of the economic expansion in the late 1980s and throughout the economic expansion in the run up to 2007, there was a steadily increasing annual current account deficit that reached 4.8% of GDP in 2007.

Since the Great Recession there has been a heavy current account deficit of around 4 to 5% of GDP reaching 5.9% in 2016. The anxiety about this is that a large current account deficit has been recorded during a period when the exchange rate had fallen. After 2007 a lower exchange rate was accompanied by consumption and economic activity that was muted during the recession and the changed pace of economic activity following 2009. Yet a notable feature of the economy was the continuing weakness of the balance of payments. There are potentially technically reasonable explanations for the high recorded deficit relating to net interest payments on UK assets, but by any criterion a deficit close to 6 per cent of GDP is high.

The UK’s comfortable life as an international rentier

From the early 1980s the UK has acquired a large holding of foreign investment assets. This has reflected three things. First, an accumulated or pent up demand for foreign investments that arose because international investment was been constrained by capital controls from 1939 until 1979. A one-off portfolio adjustment took place following the abolition of foreign exchange controls. Second influence was the consequences of surpluses on the balance of payments current account that arose from North Sea oil. And the third factor is increased recognition among professional investors that pension funds and investment trustees could maximise their returns by taking advantage of the full range of investment opportunities around the world. Professional fund managers for example construct fully global equity portfolios rather than investment strategies based around country allocations or domestic assets.

Economists at the Bank of England have now produced an arresting analysis of the UK’s balance of payments that takes account of the net flows and the level of the gross stock of assets and liabilities that make up its trade, service and capital accounts. In A prince not a pauper: the truth behind the UK’s current account deficit Stephen Burgess and Rachana Shanbhogue show that, although the UK has a balance of payments deficit that has been financed by drawing down on accumulated capital, it has a high stock of overseas financial assets in relation to annual GDP. The UK is in a very strong financial position. Between 2012 and 2016 the UK used its foreign investments to finance its balance of payments deficit. Some £520 billion of foreign assets have been liquidated, equivalent to around 6 per cent of GDP over the five year period.

Countries can no more live off capital than individuals, but the Bank of England economists point out that the UK has a very large stock of accumulated assets to call on. The stock of assets available is around 420% of GDP. It could finance a very high current account deficit for years. By any of the normal measures that economists have developed to assess the vulnerability of economies’ external accounts the UK is in a very strong position, similar to that of Japan.

Valuation effects that continue to yield benign results

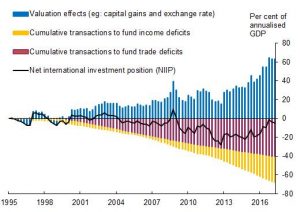

Since the Brexit decision in June 2016, the fall in the exchange rate, far from having resulted in deterioration in the UK’s external balance of assets and liabilities, has improved it. The majority of the UK’s foreign assets are denominated in foreign currencies and a significant proportion of UK foreign liabilities are denominated in sterling.

Changes in the UK’s net international investment position since 1995. Source: Bank of England

Changes in the UK’s net international investment position since 1995. Source: Bank of England

Likewise valuation effects between 2012 and 2016 arising from changes in the exchange rate and capital gains raised the net investment position of the UK by £650 billion, around £130 billion more than the value of the assets used to finance the current account.

No economy should be complacent. Economic success is the result of good policy and reliable economic institutions that command international confidence. The UK is not immune from these facts of life any more than other economies are. The Bank of England estimates that around 30% of UK government bonds are owned by foreign investors and as much of half the stock of equities and corporate bonds are foreign owned. So UK asset prices are exposed to a significant adjustment if there were to be a shock to foreign confidence in its economy. But given its stock of foreign assets and the limited foreign borrowing it has undertaken, the UK is less vulnerable to shocks arising from changes in the external judgement about UK than many other economies, such as emerging market and developing economies.

Brexit’s benign foreign-exchange adjustment

Many commentators have perceived the fall in the exchange rate that followed the Brexit decision in 2016 as some form of failure or an unfortunate incident, rather than a useful adjustment to changed circumstances. The lower exchange rate should help to rebalance the economy from consumption to manufacturing and the traded sectors of economic activity. This is helpful when an economy has a large current account deficit of close to 6% of GDP. It is also helpful that its valuation effect has been to lower our net overseas liabilities and to raise the value of our assets.

The strength of the UK’s external position is a testimony to the benefits of an open liberal economy where decisions are mage by a wide range of diverse economic agents. As a mature economy, the first to industrialise, Britain is well placed to weather any political or economic storms – and to capitalise on the opportunities Brexit presents.