Twenty years after the creation of the euro, a powerful cocktail of forces have made the southern economies of Europe permanently uncompetitive compared to the northern economies and the wider international economy. Yet the currency may limp on for years yet.

The euro was created 20 years ago. It followed 10 years of preparation from the point when the Delors Report on monetary union was published in 1989. Its conception, creation and working offer fascinating insights into monetary economics, where political power lies within the EU, and the fundamental relationships between money, economics and politics.

Slow growth and structural unemployment

The euro-zone today is distinguished by the variations in performance of the economies that make it up, its overall slow long-term trend rate of growth of around one per cent, and economies that appear to be disfigured by high structural unemployment no matter what stage of the economic cycle they are at. There are high rates of overall unemployment and high rates of youth unemployment.

The Single Market initiative, established in 1993, and the single currency – launched in 1999 – were intended to revive the dynamism of the economies of the EU. By the mid 1980s, the disappointing relative performance of the EC economies had been recognised by Europe’s institutions. This was variously described as a malaise or euro sclerosis. At its heart were structural problems in the individual member states. These arose from a combination of high ratios of public spending, heavy tax burdens making extensive use of payroll social security taxes, and clumsy regulation of product and labour markets.

The UK in the 1970s exemplified many of these structural problems. In many respects, they were worse in the UK than in the original six members of the EEC and were not fully exposed until the sustained policy of disinflation that the UK embarked on in 1979. The Thatcher agenda of public expenditure control, tax and trade union and labour market reform tackled them head on and returned the British economy to a position where it could perform in the manner expected of a normal mature advanced economy. It is that agenda of micro-economic structural reform that European economies in the southern part of the continent flinched from. Most of these challenges lay with the national member states, yet the Delors Report and its policy legacy made their management and mitigation more difficult.

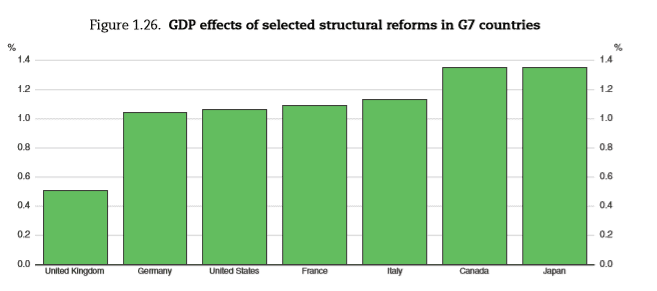

The OECD’s latest Economic Outlook assesses that the UK has made progress in structural reform. It advises that the UK has less to gain from the sort of measures that it recommends than other advanced economies.

The achievement of the Bundesbank in disinflating Europe

When the Delors Report examining monetary union was received in the summer of 1989, the EC, as it was, did not have a serious monetary or inflation problem to be addressed by the creation of a new currency and a new central bank. Good progress had been made across Europe and among the wider community of advanced economies in achieving disinflation and greater financial stability. Within Europe, this was principally through the European Monetary System, where in practice currencies committed their domestic monetary policy to the Bundesbank’s inflation objective. This had the advantage for them of importing low inflation from an exceptionally well run central bank that had pioneered the monetary approach to inflation in the 1970s and enjoyed an unusually stable set of monetary institutions and a stable demand for money that enabled it to target and to control money reliably.

Maintaining the link with the German Mark was a tough discipline, but the system offered scope for periodic devaluation when economies needed to restore competitiveness. Further, in an absolute crisis there was still scope to withdraw from the system, as the UK did in 1992, and effectively for a country to suspend its parities, as happened in the crises caused by the monetary and balance of payments consequences of German unification in 1993.

The economic reforms that the EU has really needed

While the EC did not need to create a new currency and new monetary institutions in 1989, it did need to proceed to a comprehensive structural reform of its economy. Yet what did it do? It embarked on the creation of new currency and a reformation of monetary institutions. For a single currency to work effectively, it would require well functioning, efficient and flexible product and labour markets. The EC needed radical reform to improve the functioning of both. What did it do? Instead of embarking on labour market and regulatory reform, it explored an agenda of further social regulation, its Social Action programme that was eventually embodied in the Social Chapter of the Maastricht Treaty in 1992. This agenda was originally conceived by the German and French governments as a means of handicapping Italy, Greece, Spain and Portugal ahead of the creation of the Single Market in 1993. The German social affairs minister was explicit: it was to prevent social dumping in Europe by imposing expensive German regulation on economies that were less competitive and productive. The damaging effects of this agenda were then aggravated by the creation of a common currency that would require economies to adopt efficient labour markets that could easily adjust to shocks if they were to prosper.

The contrast between German and French and southern European policy

The major continental economy that least needed a structural reform – Germany – embarked on the Hartz reforms that have compounded the challenges arsing in the euro-zone from differences in competitiveness. Germany became relatively more competitive. From 1983 France has pursued policies that are fundamentally incompatible, devised by Jacque Delors himself as finance minister. These are tight monetary conditions to deliver price stability comparable to that in Germany, exemplified by the Franc fort policy of the Mitterrand government and micro-economic policies. These hindered the working of product and labour markets, creating the conditions not just for high unemployment but more complex social and economic pathologies. President Macron is one of several leaders who have tried to offer France the structural change it needs. The difference this time is that unlike the opposition to Chirac and Sarkozy reforms, the opposition has been more violent, erupted in the centre of Paris as well as being personally directed at the authority of President Macron himself.

The result is a powerful cocktail of forces that make the southern economies of Europe permanently uncompetitive compared to the northern economies and the wider international economy. Fiscal policy has not been available to offset a defective monetary policy. The Maastricht’s fiscal rules and the practical limitations on finance ministries that cannot control their monetary institutions would constrain national governments regardless of the rules. As the euro-zone’s sovereign debt crises showed after 2011, member states fiscally are as constrained as US states or Canadian provinces when it comes to managing borrowing a debt.

Why a transfer union and President Macron’s agenda will not resolve the challenges

President Macron’s agenda of reform is to create a fiscal union where transfer payments can correct the defects of monetary policy. It is very difficult to use an alternative policy instrument to override errors arising from another defective policy. Moreover, transfer payments often yield complex crowding out effects. Economists at the ECB looking at the effects of EU structural funds described the results as a form of convergence through immiseration, where growth in the economy that receives the transfer slows, and that of the economy that foots the bill slows more.

The euro was always a political project. It purpose was to hobble the economic power of a united Germany by abolishing the naively perceived source of West German economic power – the Deutsche Mark. It failed in that objective because German economic power is based, as with all economies, on the long-term performance of real factors such as the evolution of its stock of human and physical capital, and the efficiency of its labour and other markets. From the start, the power politics of the EU were on display. Rules agreed by France and Germany to be applied to other countries could be broken when it suited the convenience of the French or German Government. In 1998, when I was the economics editor of The European, it was Germany and France that did not meet the Maastricht fiscal criteria, where national accounts had to be permitted to use sleight of hand to fit with the rules. In the same way today there is a similar asymmetry in the approach to fiscal proposals coming from France and Italy.

Asymmetric shocks in economies with markets that cannot adjust

The euro-zone’s fundamental problem is that it has never represented an approximation of an optimal currency area. There are different economic structures, and the bloc’s economies respond differently to monetary policy and economic events. Thus, without the flexibility of an independent monetary policy, an adjustable exchange rate, and discretionary fiscal policy, many countries have proved unable to respond to asymmetric shocks. This is aggravated when there is not sufficient flexibility in labour and product markets to accommodate these shocks.

Dissolution of a defective monetary regime in the face of political obduracy

It should probably be dissolved in an orderly manner. Yet the political will to maintain this economic misadventure is huge. Many people have predicted its break-up. Yet politics has a tendency to trump technical monetary economics, as the Bundesbank discovered in relation both to German monetary unification in 1990 and the creation of the euro in 1999. Moreover, monetary unions that involve prolonged and great losses of economic welfare can go on with political will. The economic history of Italy and the southern states of the US after the 1860s illustrates that. However, the story of defectively constructed monetary unions that operate without full political integration is that they break up. That was the saga of the Nordic and Latin Monetary unions of the 19th century and the international gold standard that lingered on, as Lord Keynes observed, as a ‘barbaric relic’ into the 20th century.

Warwick Lightfoot was the special adviser at the Treasury when the UK responded to the 1989 Delors report and economics editor of The European when the final preparations were being made for the introduction of the euro in 1999.