An official economic outlook that is too smooth and too pessimistic

The Office for Budget Responsibility (OBR) economic forecast was the centrepiece of the Chancellor of the Exchequer’s Spring Statement last week. It was slightly more positive than the forecast published at the time of the November Budget last year, but remains arguably pessimistic about the future course of economic activity and receipts from tax revenue.

The forecasting approach is too mechanical

The central problem with the OBR forecast is that it uses a predictive model that evades any systematic attempt to explore the way the economy works, the frameworks of causation that may be in play and how they change over time. No matter what is going on in the economy, the OBR’s methodology simply assumes that after a neatly smoothed lag everything returns to its previous path without any explanation of how this will be brought about. As an attempt to interrogate the future behaviour of the economy the approach suffers from the further limitation of incorporating overriding pure assumptions about inflation and productivity that are exogenous to the properties of the model.

A model that assumes rather than explains

Modelling future economic activity is not about producing numbers that will be right but exemplifying how the economy works and the impact that present policy may, or may not, have on its future course. A model that simply tells you it will be like the recent past with more of the same and deus ex mechina the inflation target will be achieved over the forecast period is not an informative tool for shaping policy.

Far too optimistic in the 2000s now too pessimistic about the trend rate of growth

Over the last eighteen years the Treasury forecast and that of the OBR was consistently too optimistic about the performance of the UK economy. Gordon Brown and Alistair Darling were provided with forecasts that were too optimistic with an assumed trend rate of growth that was scored at 2.75 per cent. After the creation of the OBR the forecast remained too optimistic about growth and revenue. The OBR has now produced a stylised forecast that is probably too pessimistic as well too mechanically smooth in its numerical projections.

OBR is effectively forecasting a permanent ‘growth recession’

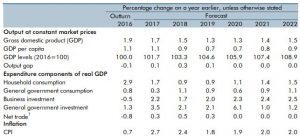

The assumed trend rate of growth is now estimated to be 1.5 per cent. Trivially, the OBR’s prediction of GDP growth for 2018 has been increased to 1.5 per cent from the 1.4 per cent forecast in November. This partly offsets reductions in GDP growth of 0.1 per cent in the final two years of the five year forecast period. The table below shows how the OBR effectively projects a ‘growth recession’ between now and 2022. The rate of GDP growth falls from 1.5 percent to 1.3 per cent in 2019 and 2020, then starts to rise gently in 2021 to 1.4 per cent and 1.5 per cent in 2022.During that period there is virtually no output gap and inflation neatly glides down from 2.7 percent in 2017 to2.4 per cent this year, bottoms out at 1.8 per cent in 2019 and then gets back to 2 per cent in 2021, where it remains.

The OBR Economic Forecast March 2018

In 2000s public spending crowded out private sector economic activity

Leaving aside the technical questions about the construction of the model – and the information that this sort of forecast approach may yield for policy makers wanting to understand the UK economy – the present forecast appears both too pessimistic and too static. The trend rate of growth in the 2000s was never 2.75 per cent. Because of discretionary policy measures it was likely to be falling from the long-term 2.25 -2.5 per cent trend path the economy appeared to be on for many years before 2000.

The complicated legacy of the Great Recession

The Great Recession has had further complicated effects, not least on the capacity of the banking system to create credit. In addition, the monetary measures taken to stabilise output appear to have blunted some of the natural rhythm of change and reorganisation in the economy that Joseph Schumpeter described as a process of creative destruction. The trend rate of growth is probably something more like 1.7 or 1.9 per cent. The OBR figure is pessimistic.

Could there be come benign crowding of private sector economic activity?

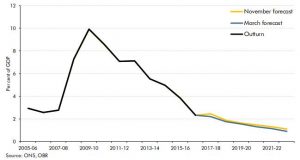

After many years when ‘Big Government’ policies meant that the public finances were systematically modifying the trend rate of growth in a negative manner, the UK supply side may be now enjoying a process of benign effects. The ratio of public spending to GDP has now fallen to 38.9 per cent and is projected to fall to 37.7 in 2022. This offers scope for a dynamic where there is crowding in rather than crowding out of private sector activity. In relation to the immediate economic cycle the falling level of borrowing and the prospect of some scope to re-examine aspects of regulation will improve the confidence of economic agents.

Public sector net borrowing

Capacity constraints point to the need for tighter domestic monetary conditions

While the OBR has revised up its forecast for output this year from 1.4 to 1.5 per cent, that remains too pessimistic a gloss on present economy activity. We still think it will be more like our estimate of trend growth around 1.7 to 1.9 per cent with the ‘risk’ on the upside. Given the lack of spare capacity in the economy and the scale of the balance of payments deficit, we think that the central bank should make progress on tightening domestic monetary conditions with the objective of getting interest rates to a more ‘normal’ rate of around 3 per cent. This would not only be desirable for conventional reason of macro-economic management, but would help to address some of the complex micro-economic issues that have arisen in credit markets since the credit crunch and the Great Recession.

What wealth and consumption effects could arise from a return to ‘normal’ interest rates?

An interesting omission from the analysis accompanying the forecast tables is any discussion about the consequences of higher interest rates for house prices, bank balance sheets, wealth effects and consumption. Some models suggest that an increase in real interest rates of 100 basis points would ultimately reduce house prices by around 6 per cent. Given that the central bank is going to be tightening policy after a protracted period of unusually low interest rates, it would have been interesting to have the benefit of the OBR’s guidance on their likely impact on the economy.

Fiscal Policy will remain highly constrained

The OBR’s pessimistic forecast will constrain discretionary decisions to increase spending or cut taxes. The principal scope to adjust fiscal arithmetic in future years will come from the opportunity to reorder the spending presently assigned for the net contribution to the EU budget.

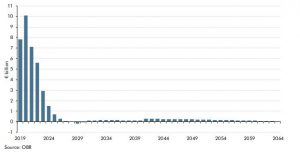

Annual path of financial settlement payments to the EU

The saving projected by the OBR compared to their projection payments without Brexit is instructive. The sum involved is around £10 billion. This is equivalent to about 2p on the basic rate of income tax. That bill would have been a permanent and potentially rising share of UK public spending given that part of it is based on estimates of national income, the GNI component of the table below, and the vulnerability of the UK budget rebate negotiated at Fontainebleau in 1984.

Total UK contributions to the EU if we remained a member