This week, the Bank of England will be hosting a conference to mark the 20th anniversary of having been granted its independence, and the creation of the Bank’s Monetary Policy Committee. Ten years ago, the tenth anniversary of this event was celebrated with confident and happy encomia. Unfortunately, these encomia were delivered just as the greatest monetary shock to hit capitalism since 1931 arrived. Ten years after the credit crunch, contemporary central banks still face many fundamental challenges, and the Bank’s conference agenda looks like an interesting and stimulating way of exploring these. It will likely be heavily informed by the Governor Mark Carney’s interesting Michel Camdessus lecture at the IMF last week on globalisation and inflation.

How did we get into our problems?

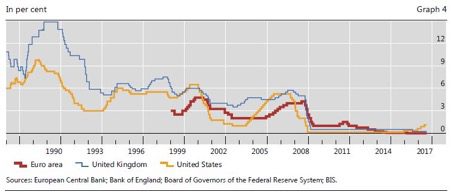

The starting point for looking at the present challenges in this area is to recognise that monetary policy was at the heart of the monetary shock in 2007. Led by the Federal Reserve in the US, global monetary conditions were too loose. Over-expanded bank balance sheets blew up, leading to a collapse in confidence, and bank lending that created a severe deflationary shock. A succession of defective frameworks of regulation, perverse incentives, and moral hazards — such as those surrounding the US federally-chartered housing agencies — blew up in a perfect storm. The one institution that had warned consistently about the loose monetary condition facilitating this storm was the Bank for International Settlements.

Development of central bank policy rates over the last three decades:

The core problem before 2007 was that central banks forward-looking inflation targets did not take enough account of changes in asset prices. The models that central banks used for their forecasts did not take account of money, changes in supply performance, and the implications of changes in asset prices. They had a tendency to project both stable output and stable prices. Rapid increases in asset prices, such as house prices and equity prices, were ignored. There was also a confident belief that as a result of the Basel rules relating to bank capital those banks were better capitalised and regulated than before.

Political pressure to run policies that are too accommodating

Although central banks were nominally independent, they remained subject to public and political pressure to ensure that economies expanded at their trend rates of growth with no slack. This supposed that they had an accurate purchase on trend growth, and were capable of highly refined discretionary judgements about demand management policy — but this is very hard to do without a serious policy error.

Economic models and fundamental relationships that no longer mechanically hold

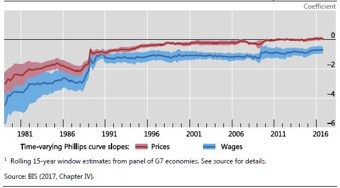

Many of the contemporary challenges of central banks remain rooted in targets and policy frameworks that have changed little over the last ten years. These include inflation targets that take no account of asset prices and wealth effects arising from them, and economic models in which central propositions about output, employment, and prices do not appear to hold in any reliable manner. This is exemplified by the present puzzle over strong US employment growth and weaker than expected inflation upending the Federal Reserve Board’s judgement that some form of the longstanding Phillips Curve still holds.

A flatter Phillips curve for prices and (less so) wages1:

The work of the central banks is also made difficult because of the consequences of the monetary policies they have used to stabilise and sustain economic activity since the great recession. The combination of very low interest rates, quantitative easing, and forward guidance has had complex consequences. Before exploring that, however, it is worth acknowledging how successful policy has been. The recoveries in the US and UK have been built around monetary stimulus engineered by central banks. The fact that the great recession did not become something much worse, and damaging on the scale of the Great Depression, was largely owing to Ben Bernanke at the Federal Reserve Board, and Timothy Geithner, the President of the Federal Reserve Bank of New York and the late US Treasury Secretary.

Microeconomic distortion arising from monetary policy has increased risk appetites

Yet the policies that have been successful in stabilising the macro-economy have thrown up complex microeconomic problems that will make future policy difficult. The combination of very low interest rates and asset purchases by central banks have distorted the pricing of risk, and encouraged risk taking. This will result in future instability and malign shocks. Large firms have been able to borrow huge amounts very cheaply in the bond markets, while small and medium-sized firms have struggled to get credit and capital.

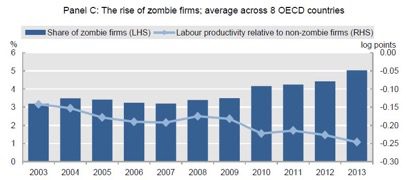

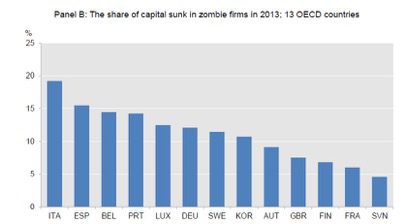

The rise of the zombie enterprise

Monetary policy has created conditions where so-called zombie firms, which have persistent problems with interest payments, are kept going with damaging consequences for productivity. The cocktail of low interest rates, bank forbearance, and the persistence of crisis-induced support for SMEs keeps underperforming and failing enterprises alive. This prevents the expansion of healthier and more dynamic firms, creates barriers to entry, and slows productivity growth. A phenomena first observed in Japan following its banking crisis in the 1990s has become widespread across advanced economies. This is explored in an OECD paper The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries. The paper observes that an increase in the capital stock sunk in zombie firms is associated with less productivity enhancing capital reallocation and a measured decline in the ability of more productive firms to attract capital.

Normalcy, vigilance, and instability in a fiat monetary system

Central banks need to return interest rates to a more normal rate than the present very low rates. This more normal rate would likely to be very low compared to previous ideas of what a normal or neutral level of interest rates might be. As well as undoing some of the damaging micro-economic consequences, higher rates would give policy makers headroom to cut rates in when they have to deal with future adverse shocks. As well as raising rates, central banks are right to be thinking about winding down their hugely expanded balance sheets.

Policy makers need to be equally vigilant in being willing to respond to threats of inflation and deflation. There are huge amounts of liquidity, and globalisation has increased the productive potential of the world economy while aging demographies in advanced economies constrains demand. This is a recipe for unknowable uncertainty. In the 1970s, an Oxford economist, John Flemming, wrote a book about inflation while commuting by train to London for a year to work at the Bank of England. This was at the height of the UK’s inflationary spiral in 1975. Flemming showed how swiftly inflation can increase through a process of gearing up. In recent years, we have experienced the way in which inflationary expectations can gear down, but the process could be thrown into reverse. Fiat money is unstable and retains the capacity to surprise.